Business, 20.09.2021 05:50 heyysn3858

Current Designs manufactures kayaks. Pedal Boats, Inc. has approached Current Designs about using its rotomold expertise and equipment to produce some pedal boat components for Pedal Boats Inc. Current Designs is interested in exploring this opportunity but is concerned that the pedal boats are a different shape than the kayaks it currently produces. Current Designs would need to buy an additional rotomold oven in order to produce the pedal boat components. This project clearly involves risks, and management wants to ensure the returns justify the risks.

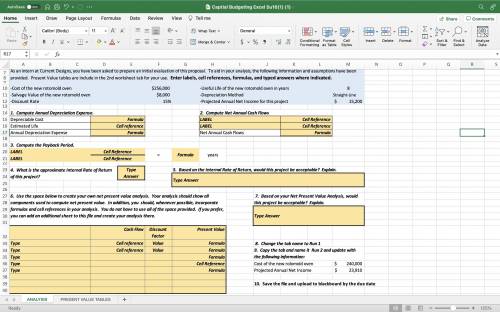

As an intern at Current Designs, you have been asked to prepare an initial evaluation of this proposal. To aid in your analysis, the following information and assumptions have been provided. Present Value tables are included in the 2nd worksheet tab for your use. Enter labels, cell references, formulas, and typed answers where indicated.

-Cost of the new rotomold oven $256,000 -Useful Life of the new rotomold oven in years 8

-Salvage Value of the new rotomold oven $8,000 -Depreciation Method Straight-Line

-Discount Rate 15% -Projected Annual Net Income for this project $15,200

1. Compute Annual Depreciation Expense. 2. Compute Net Annual Cash Flows

Depreciable Cost Formula LABEL Cell Reference

Estimated Life Cell reference LABEL Cell Reference

Annual Depreciation Expense Formula Net Annual Cash Flows Formula

3. Compute the Payback Period.

LABEL Cell Reference = Formula years

LABEL Cell Reference

4. What is the approximate Internal Rate of Return of this project? Type Answer 5. Based on the Internal Rate of Return, would this project be acceptable? Explain.

Type Answer

6. Use the space below to create your own net present value analysis. Your analysis should show all components used to compute net present value. In addition, you should, whenever possible, incorporate formulas and cell references in your analysis. You do not have to use all of the space provided. If you prefer, you can add an additional sheet to this file and create your analysis there. 7. Based on your Net Present Value Analysis, would this project be acceptable? Explain.

Type Answer

Cash Flow Discount Factor Present Value

Type Cell reference Value Formula 8. Change the tab name to Run 1

Type Cell reference Value Formula 9. Copy the tab and name it Run 2 and update with the following information:

Type Formula

Type Cell Reference Cost of the new rolomold oven $240,000

Type Formula Projected Annual Net Income $23,910

Answers: 1

Another question on Business

Business, 22.06.2019 07:10

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u.s. parent on bank deposits held in london d. interest received by a u.s. parent on a loan to a subsidiary in mexico e. principal repayment received by u.s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u.s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 12:50

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 19:10

Pam is a low-risk careful driver and fran is a high-risk aggressive driver. to reveal their driver types, an auto-insurance company a. refuses to insure high-risk drivers b. charges a higher premium to owners of newer cars than to owners of older cars c. offers policies that enable drivers to reveal their private information d. uses a pooling equilibrium e. requires drivers to categorize themselves as high-risk or low-risk on the application form

Answers: 3

You know the right answer?

Current Designs manufactures kayaks. Pedal Boats, Inc. has approached Current Designs about using it...

Questions

Chemistry, 30.10.2021 05:10

Mathematics, 30.10.2021 05:10

Business, 30.10.2021 05:10

Social Studies, 30.10.2021 05:10

Mathematics, 30.10.2021 05:10

English, 30.10.2021 05:10

Mathematics, 30.10.2021 05:10

History, 30.10.2021 05:10

Mathematics, 30.10.2021 05:10

Spanish, 30.10.2021 05:10

Physics, 30.10.2021 05:10