Business, 10.10.2021 14:00 tylorroundy

4. Down Under Boomerang, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $3 million. The fixed asset falls into the three-year MACRS class. The project is estimated to generate $2,180,000 in annual sales, with costs of $855,000. The project requires an initial investment in net working capital of $400,000, and the fixed asset will have a market value of $260,000 at the end of the project.

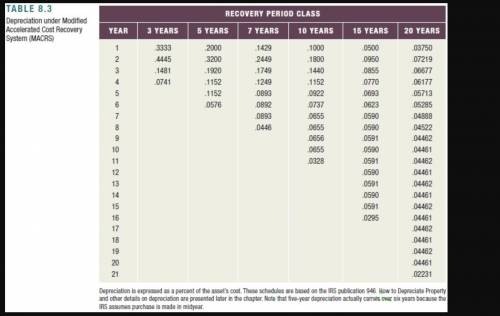

a. If the tax rate is 25 percent, what is the project’s Year 1 net cash flow? Year 2? Year 3? Table 8.3. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e. g., 1,234,567.89.)

b. If the required return is 9 percent, what is the project's NPV? (Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 1,234,567.89.)

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

On january 1, 2018, red flash photography had the following balances: cash, $19,000; supplies, $8,700; land, $67,000; deferred revenue, $5,700; common stock $57,000; and retained earnings, $32,000. during 2018, the company had the following transactions: 1. february 15 issue additional shares of common stock, $27,000. 2. may 20 provide services to customers for cash, $42,000, and on account, $37,000. 3. august 31 pay salaries to employees for work in 2018, $30,000. 4. october 1 purchase rental space for one year, $19,000. 5. november 17 purchase supplies on account, $29,000. 6. december 30 pay dividends, $2,700. the following information is available on december 31, 2018: 1. employees are owed an additional $4,700 in salaries. 2. three months of the rental space has expired. 3. supplies of $5,700 remain on hand. 4. all of the services associated with the beginning deferred revenue have been performed.required: 1. record the transactions that occurred during the year.2. record the adjusting entries at the end of the year.3. prepare an adjusted trial balance.4. prepare an income statement, statement of stockholders’ equity, and classified balance sheet.5. prepare closing entries.

Answers: 2

Business, 22.06.2019 21:50

Required: 1-a. the marketing manager argues that a $5,000 increase in the monthly advertising budget would increase monthly sales by $9,000. calculate the increase or decrease in net operating income. 1-b. should the advertising budget be increased ? yes no hintsreferencesebook & resources hint #1 check my work 8.value: 1.00 pointsrequired information 2-a. refer to the original data. management is considering using higher-quality components that would increase the variable expense by $2 per unit. the marketing manager believes that the higher-quality product would increase sales by 10% per month. calculate the change in total contribution margin. 2-b. should the higher-quality components be used? yes no

Answers: 1

Business, 22.06.2019 22:40

Which of the following will not cause the consumption schedule to shift? a) a sharp increase in the amount of wealth held by households b) a change in consumer incomes c) the expectation of a recession d) a growing expectation that consumer durables will be in short supply

Answers: 1

Business, 23.06.2019 09:40

Max wants to open a basic checking account at his local bank. he needs to bring his and , along with a $50 deposit, to open the account.

Answers: 3

You know the right answer?

4. Down Under Boomerang, Inc., is considering a new three-year expansion project that requires an in...

Questions

Mathematics, 17.11.2020 21:10

Arts, 17.11.2020 21:10

Mathematics, 17.11.2020 21:10

English, 17.11.2020 21:10

Mathematics, 17.11.2020 21:10

Computers and Technology, 17.11.2020 21:10

Chemistry, 17.11.2020 21:10

Mathematics, 17.11.2020 21:10