Instructions: use the percentage and wage-bracket method to compute federal income taxesto withhold from wages.

Here is the question: Cal is married and has 4 withholding allowances. His semi-monthly salary is $2480.

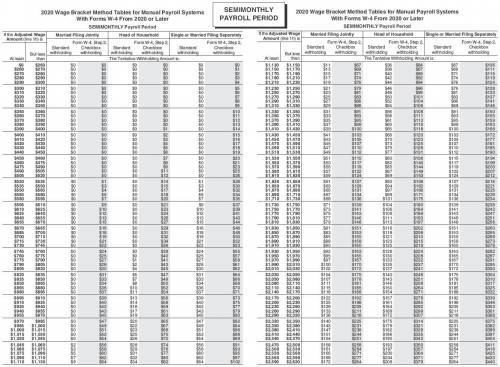

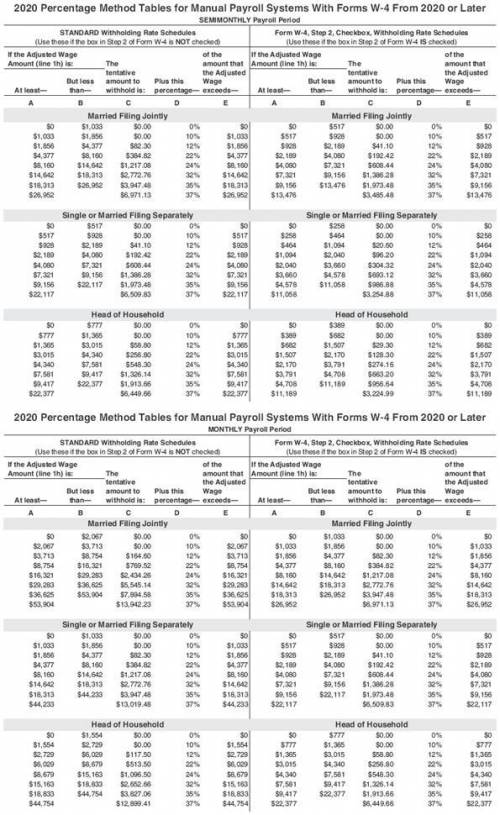

For this problem, the 2020 federal income tax tables for Manual Payroll Systems with Forms W-4 from 2019 or earlier and 2020 FICA rates have been used. See attached.

When I calculated this, I got $138.40 for the percentage method and $158 for the wage bracket method. Both are wrong and they're usually really close to the same number.

Table of Allowance Values for 2020

Weekly 83.00 Biweekly 165.00 Semimonthly 179.00 Monthly 358.00

Quarterly 1,075.00 Semiannual 2,150.00 Annual 4,300.00 Daily/Misc. 17.00

Examples of how to calculate this:

Example 4-12

To compute the tax using the percentage method for Manual Payroll Systems with Forms W-4 or Earlier, follow the steps illustrated below.

Step 1

Determine the amount of gross wages earned, marital status, number of allowances, and frequency of pay. Note: If the wage ends in a fractional dollar amount, the wage may be rounded to the nearest dollar. However, in this text, exact wages are used.

→ Wilson Goodman, single, claims two allowances and earns $915.60 semimonthly.

Step 2

Multiply the number of allowances claimed by the amount of one allowance for the appropriate payroll period, as shown in the Table of Allowance Values in Figure 4.19. → Table of Allowance Values for semimonthly payroll period shows $179.00.

Multiply $179.00 × 2 = $358.00

Step 3

Subtract the amount for the number of allowances claimed from the employee’s gross pay to find the excess of wages over allowances claimed. →

Gross pay $ 915.60

Less: Allowances 358.00

Excess wages $557.60

Step 4

Determine the withholding tax on the excess of wages over allowances claimed by referring to the appropriate Percentage Method Withholding Table. → Compute tax from Tax Table C, page T-15.

($557.60 - $158.00 = $399.60 × 10% = $39.96 + $0) = $39.96

Example 4-13

To use the wage-bracket method tables for Manual Payroll Systems with Forms W-4 From 2019 or Earlier, follow the steps illustrated below.

Step 1

Select the withholding table that applies to the employee’s marital status and pay period.

→ Adrienne Huff is married and claims 3 allowances.

She is paid weekly at a rate of $815.

Step 2

Locate the wage bracket (the first two columns of the table) in which the employee’s gross wages fall. → Locate the appropriate wage bracket (see Figure 4.20):

At least $805 but less than $820

Step 3

Follow the line for the wage bracket across to the right to the column showing the appropriate number of allowances. Withhold this amount of tax. → Move across the line to the column showing 3 allowances.

The tax to withhold is $34.

Answers: 3

Another question on Business

Business, 21.06.2019 20:10

In three to four sentences, explain the effect of a price ceiling on the quantity of a good and who this intervention intends to assist

Answers: 3

Business, 22.06.2019 07:30

Select the correct answer. sarah works in a coffee house where she is responsible for keying in customer orders. a customer orders snacks and coffee, but later, cancels th snacks, saying she wants only coffee. at the end of the day, sarah finds that there is a mismatch in the snack items ordered. which term suggest data has been violated? a. security b. integrity c. adding d. reliability e. reporting

Answers: 3

Business, 22.06.2019 11:10

Verizon communications, inc., provides the following footnote relating to its leasing activities in its 10-k report. the aggregate minimum rental commitments under noncancelable leases for the periods shown at december 31, 2010, are as follows: years (dollars in millions) capital leases operatingleases 2011 $97 $1,898 2012 74 1,720 2013 70 1,471 2014 54 1,255 2015 42 1,012 thereafter 81 5,277 total minimum 418 $ 12,633 rental commitments less interest and (86) executory costs present value of 332 minimum lease payments less current (75) installments long-term obligation $257 at december 31, 2010 (a) confirm that verizon capitalized its capital leases using a rate of 7.4 %. (b) compute the present value of verizon's operating leases, assuming an 7.4% discount rate and rounding the remaining lease term to 3 decimal places. (use a financial calculator or excel to compute. do not round until your final answers. round each answer to the nearest whole number.)

Answers: 2

Business, 22.06.2019 11:50

Stocks a, b, and c are similar in some respects: each has an expected return of 10% and a standard deviation of 25%. stocks a and b have returns that are independent of one another; i.e., their correlation coefficient, r, equals zero. stocks a and c have returns that are negatively correlated with one another; i.e., r is less than 0. portfolio ab is a portfolio with half of its money invested in stock a and half in stock b. portfolio ac is a portfolio with half of its money invested in stock a and half invested in stock c. which of the following statements is correct? a. portfolio ab has a standard deviation that is greater than 25%.b. portfolio ac has an expected return that is less than 10%.c. portfolio ac has a standard deviation that is less than 25%.d. portfolio ab has a standard deviation that is equal to 25%.e. portfolio ac has an expected return that is greater than 25%.

Answers: 3

You know the right answer?

Instructions: use the percentage and wage-bracket method to compute federal income taxesto withhold...

Questions

Mathematics, 02.02.2021 14:00

Mathematics, 02.02.2021 14:00

Mathematics, 02.02.2021 14:00

Mathematics, 02.02.2021 14:00