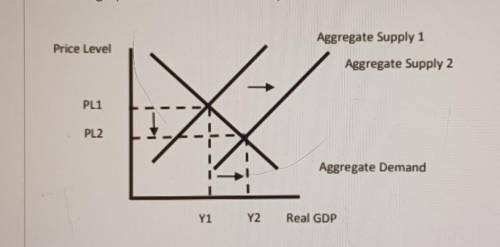

The federal government passes a series of deregulations that impact almost all American industries. How does deregulation impact the overall price level in the economy?

O overall price levels rise

O overall price levels decrease

O overall price levels stay the same

O overall prices levels don't change

Answers: 1

Another question on Business

Business, 21.06.2019 15:00

Abroker showed one of his own listings to a buyer he was representing. the buyer decided to make an offer on the property, which was accepted. at no point did the broker disclose his dual agency status. the broker may be:

Answers: 3

Business, 21.06.2019 17:20

Your aunt is thinking about opening a hardware store. she estimates that it would cost $300,000 per year to rent the location and buy the stock. in addition, she would have to quit her $45,000 per year job as an accountant. a. define opportunity cost. b. what is your aunt's opportunity cost of running a hardware store for a year? if your aunt thought she could sell $350,000 worth of merchandise in a year, should she open the store? explain.

Answers: 2

Business, 22.06.2019 11:50

The smelting department of kiner company has the following production and cost data for november. production: beginning work in process 3,700 units that are 100% complete as to materials and 23% complete as to conversion costs; units transferred out 10,500 units; and ending work in process 8,100 units that are 100% complete as to materials and 41% complete as to conversion costs. compute the equivalent units of production for (a) materials and (b) conversion costs for the month of november. materials conversion costs total equivalent units

Answers: 1

Business, 22.06.2019 11:50

Stocks a, b, and c are similar in some respects: each has an expected return of 10% and a standard deviation of 25%. stocks a and b have returns that are independent of one another; i.e., their correlation coefficient, r, equals zero. stocks a and c have returns that are negatively correlated with one another; i.e., r is less than 0. portfolio ab is a portfolio with half of its money invested in stock a and half in stock b. portfolio ac is a portfolio with half of its money invested in stock a and half invested in stock c. which of the following statements is correct? a. portfolio ab has a standard deviation that is greater than 25%.b. portfolio ac has an expected return that is less than 10%.c. portfolio ac has a standard deviation that is less than 25%.d. portfolio ab has a standard deviation that is equal to 25%.e. portfolio ac has an expected return that is greater than 25%.

Answers: 3

You know the right answer?

The federal government passes a series of deregulations that impact almost all American industries....

Questions

Mathematics, 29.12.2020 05:00

Computers and Technology, 29.12.2020 05:00

Health, 29.12.2020 05:00

Mathematics, 29.12.2020 05:10

History, 29.12.2020 05:10

History, 29.12.2020 05:10

Social Studies, 29.12.2020 05:10

Mathematics, 29.12.2020 05:10

Mathematics, 29.12.2020 05:10

Arts, 29.12.2020 05:10