Business, 17.10.2021 17:00 tiwaribianca475

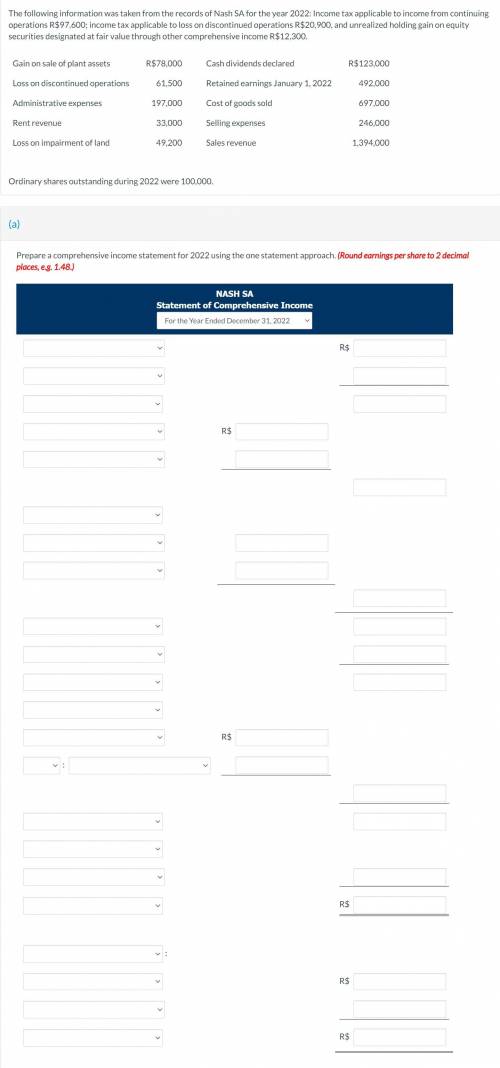

The following information was taken from the records of Nash SA for the year 2022: Income tax applicable to income from continuing operations R$97,600; income tax applicable to loss on discontinued operations R$20,900, and unrealized holding gain on equity securities designated at fair value through other comprehensive income R$12,300.

Gain on sale of plant assets

R$78,000

Cash dividends declared

R$123,000

Loss on discontinued operations

61,500

Retained earnings January 1, 2022

492,000

Administrative expenses

197,000

Cost of goods sold

697,000

Rent revenue

33,000

Selling expenses

246,000

Loss on impairment of land

49,200

Sales revenue

1,394,000

Ordinary shares outstanding during 2022 were 100,000.

Answers: 1

Another question on Business

Business, 22.06.2019 12:50

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. consider all factors that affect the yield curve. then identify which of the following shapes that the u.s. treasury yield curve can take. check all that apply.

Answers: 2

Business, 22.06.2019 18:10

Find the zeros of the polynomial 5 x square + 12 x + 7 by factorization method and verify the relation between zeros and coefficient of the polynomials

Answers: 1

Business, 22.06.2019 21:10

Upon completion of the northwest-corner rule, which source-destination cell is guaranteed to be occupied? a. top-leftb. the cell with the lowest shipping costc. bottom-leftd. top-righte. bottom-right

Answers: 1

Business, 22.06.2019 23:00

Sailcloth & more currently produces boat sails and is considering expanding its operations to include awnings for homes and travel trailers. the company owns land beside its current manufacturing facility that could be used for the expansion. the company bought this land 5 years ago at a cost of $319,000. at the time of purchase, the company paid $24,000 to level out the land so it would be suitable for future use. today, the land is valued at $295,000. the company has some unused equipment that it currently owns valued at $38,000. this equipment could be used for producing awnings if $12,000 is spent for equipment modifications. other equipment costing $490,000 will also be required. what is the amount of the initial cash flow for this expansion project?

Answers: 2

You know the right answer?

The following information was taken from the records of Nash SA for the year 2022: Income tax applic...

Questions

Chemistry, 05.08.2021 04:10

Mathematics, 05.08.2021 04:10

Mathematics, 05.08.2021 04:20

English, 05.08.2021 04:20

English, 05.08.2021 04:20

Mathematics, 05.08.2021 04:20

Mathematics, 05.08.2021 04:20