Question 4 of 10

Jessie's car broke down, and she needs to borrow money to pay for repairs.

...

Business, 25.11.2021 14:00 leandroarguijo

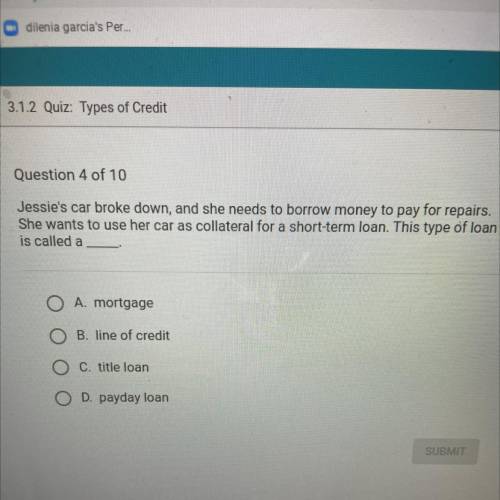

Question 4 of 10

Jessie's car broke down, and she needs to borrow money to pay for repairs.

She wants to use her car as collateral for a short-term loan. This type of loan

is called a

A. mortgage

B. line of credit

O C. title loan

D. payday loan

Answers: 1

Another question on Business

Business, 22.06.2019 05:10

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 21:10

An investor purchases 500 shares of nevada industries common stock for $22.00 per share today. at t = 1 year, this investor receives a $0.42 per share dividend (which is not reinvested) on the 500 shares and purchases an additional 500 shares for $24.75 per share. at t = 2 years, he receives another $0.42 (not reinvested) per share dividend on 1,000 shares and purchases 600 more shares for $31.25 per share. at t = 3 years, he sells 1,000 of the shares for $35.50 per share and the remaining 600 shares at $36.00 per share, but receives no dividends. assuming no commissions or taxes, the money-weighted rate of return received on this investment is closest to:

Answers: 3

Business, 22.06.2019 23:30

An outside supplier has offered to sell talbot similar wheels for $1.25 per wheel. if the wheels are purchased from the outside supplier, $15,000 of annual fixed overhead could be avoided and the facilities now being used could be rented to another company for $45,000 per year. direct labor is a variable cost. if talbot chooses to buy the wheel from the outside supplier, then annual net operating income would:

Answers: 1

Business, 23.06.2019 18:00

What makes business writing different from fictional writing?

Answers: 1

You know the right answer?

Questions

Mathematics, 15.04.2021 20:50

Mathematics, 15.04.2021 20:50

English, 15.04.2021 20:50

Mathematics, 15.04.2021 20:50

Health, 15.04.2021 20:50

Mathematics, 15.04.2021 20:50

Arts, 15.04.2021 20:50

Mathematics, 15.04.2021 20:50

Chemistry, 15.04.2021 20:50