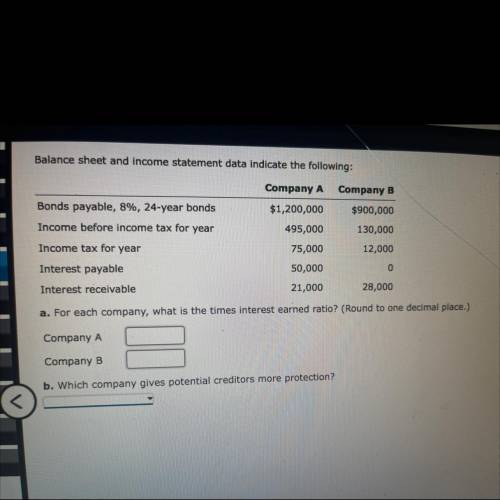

Balance sheet and income statement data indicate the following:

Company A

Company B

Bo...

Business, 04.12.2021 19:20 kitttimothy55

Balance sheet and income statement data indicate the following:

Company A

Company B

Bonds payable, 8%, 24-year bonds

Income before income tax for year

$1,200,000

$900,000

495,000

130,000

Income tax for year

75,000

12,000

Interest payable

50,000

Interest receivable

21,000

28,000

a. For each company, what is the times interest earned ratio? (Round to one decimal place.)

Company A

Company B

b. Which company gives potential creditors more protection?

Answers: 3

Another question on Business

Business, 21.06.2019 16:00

Excellent inc. had a per-unit conversion cost of $3.00 during april and incurred direct materials cost of $112,000, direct labor costs of $84,000, and manufacturing overhead costs of $50,400 during the month. how many units did it manufacture during the month? a. 18,000 b. 44,800 c. 70,000 d. 30,000

Answers: 1

Business, 22.06.2019 05:00

You are chairman of the board of a successful technology firm. there is a nominal federal corporate tax rate of 35 percent, yet the effective tax rate of the typical corporation is about 12.6%. your firm has been clever with use of transfer pricing and keeping money abroad and has barely paid any taxes over the last 5 years; during this same time period, profits were $28 billion. one member of the board feels that it is un-american to use various accounting strategies in order to avoid paying taxes. others feel that these are legal loopholes and corporations have a fiduciary responsibility to minimize taxes. one board member quoted what the ceo of exxon once said: “i’m not a u.s. company and i don’t make decisions based on what’s good for the u.s.” what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 2

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 21:00

In a transportation minimization problem, the negative improvement index associated with a cell indicates that reallocating units to that cell would lower costs.truefalse

Answers: 1

You know the right answer?

Questions

History, 12.07.2019 08:00

Mathematics, 12.07.2019 08:00

English, 12.07.2019 08:00

History, 12.07.2019 08:00

Mathematics, 12.07.2019 08:00

Mathematics, 12.07.2019 08:00

Mathematics, 12.07.2019 08:00

Mathematics, 12.07.2019 08:00