Business, 10.12.2021 21:50 MelissaSmartypants

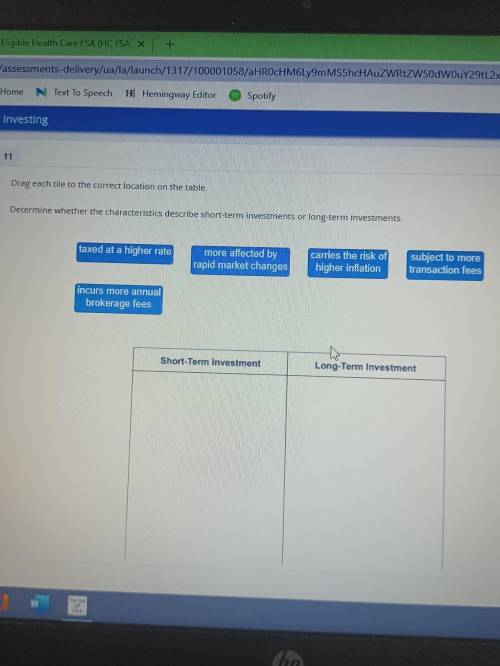

Drag each vile to the correa location on the table. Determine whether the characteristics describe short-term investments or long-term investments, taxed at a higher rate more affedied by rapid market changes cartes the risk of higher inflation subject to more transaction fees incurs more annual brokerage fees Short-Term Investment Long-Term Investment

Answers: 2

Another question on Business

Business, 21.06.2019 16:40

Dollywood corporation accumulates the following data concerning a mixed cost, using miles as the activity level. miles driven total cost january 10,000 $16,500 february 8,000 $14,500 march 9,000 $12,500 april 7,000 $12,000 compute the variable and fixed cost elements using the high-low method

Answers: 3

Business, 22.06.2019 05:30

From a business perspective, an information system provides a solution to a problem or challenge facing a firm and represents a combination of management, organization, and technology elements. the organization's hierarchy, functional specialties, business processes, culture, and political interest groups are components of which element of information systems?

Answers: 1

Business, 22.06.2019 08:40

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity.calculate the cost of new stock using the dividend growth approach.what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics.each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings.equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

Business, 22.06.2019 13:50

Read the following paragraph, and choose the best revision for one of its sentences.dr. blake is retiring at the end of the month. there will be an unoccupied office upon his departure, and it is big in size. because every other office is occupied, we should convert dr. blake’s office into a lounge. it is absolutely essential that this issue is discussed at the next staff meeting. (a) because every other office is occupied, it’s recommended that we should convert dr. blake’s office into a lounge. (b) because every other office is filled, we should convert dr. blake’s office into a lounge.

Answers: 2

You know the right answer?

Drag each vile to the correa location on the table. Determine whether the characteristics describe s...

Questions

Mathematics, 04.11.2021 14:00

English, 04.11.2021 14:00

Mathematics, 04.11.2021 14:00

English, 04.11.2021 14:00

History, 04.11.2021 14:00

Computers and Technology, 04.11.2021 14:00

History, 04.11.2021 14:00

Computers and Technology, 04.11.2021 14:00

Chemistry, 04.11.2021 14:00

History, 04.11.2021 14:00

Mathematics, 04.11.2021 14:00