Business, 03.01.2022 16:40 jeniferfayzieva2018

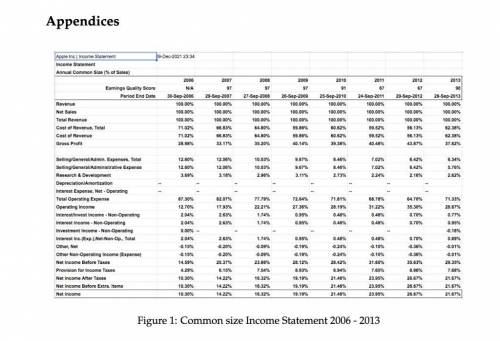

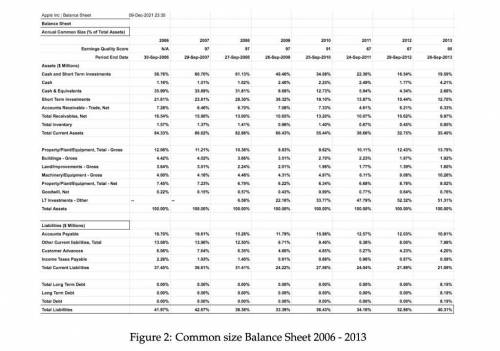

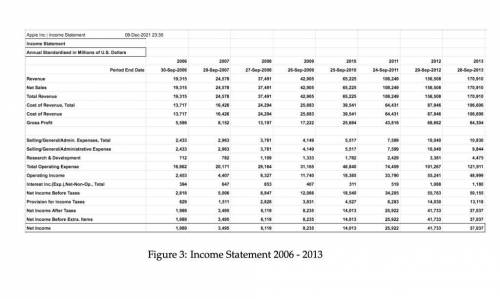

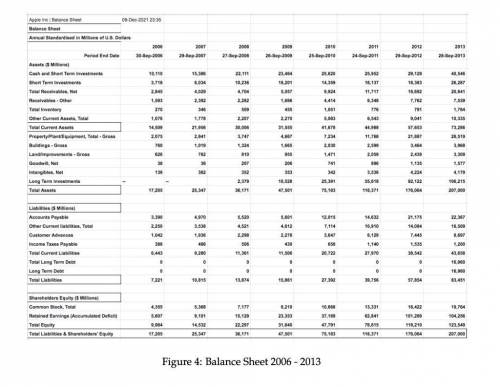

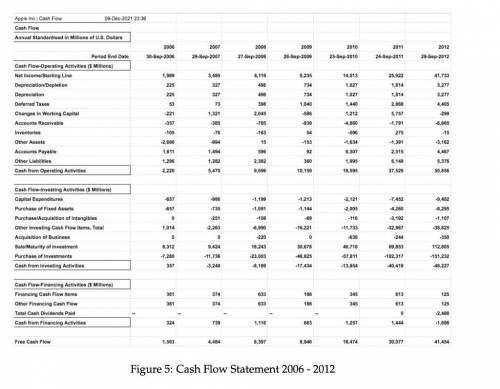

1. From its peak in September 2012 to the end of March 2013, Apple’s stock price fell by

37%, from $702.10 to $442.66. Examine ONLY the financial reports (in the appendices)

and identify areas that were responsible for this stock performance.

2. State the amount of cash holdings Apple reported in their 2020 annual report (10-k)1 and state Apple’s plan to disburse cash holdings for 2020 and beyond.

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

Nominal gross domestic producta. is a measure of the overall level of pricesb. measures the value of final goods and services produced within the borders of a given country during a given time period using current pricesc. measures the value of final goods and services produced within the borders of a given country during a given time period corrected for changing pricesd. only changes when the level of output changes

Answers: 2

Business, 22.06.2019 12:50

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

Business, 22.06.2019 19:40

Your father's employer was just acquired, and he was given a severance payment of $375,000, which he invested at a 7.5% annual rate. he now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. how many years will it take to exhaust his funds, i.e., run the account down to zero? a. 22.50 b. 23.63 c. 24.81 d. 26.05 e. 27.35

Answers: 2

Business, 22.06.2019 21:40

The farmer's market just paid an annual dividend of $5 on its stock. the growth rate in dividends is expected to be a constant 5 percent per year indefinitely. investors require a 13 percent return on the stock for the first 3 years, a 9 percent return for the next 3 years, a 7 percent return thereafter. what is the current price per share? select one: a. $212.40 b. $220.54 c. $223.09 d. $226.84 e. $227.50 previous pagenext page

Answers: 2

You know the right answer?

1. From its peak in September 2012 to the end of March 2013, Apple’s stock price fell by

37%, from...

Questions

Chemistry, 08.10.2019 17:20

Biology, 08.10.2019 17:20

Spanish, 08.10.2019 17:20

Biology, 08.10.2019 17:20

Arts, 08.10.2019 17:20

English, 08.10.2019 17:20

Mathematics, 08.10.2019 17:30

Mathematics, 08.10.2019 17:30

English, 08.10.2019 17:30

History, 08.10.2019 17:30