Business, 06.02.2022 14:00 piggygirl211

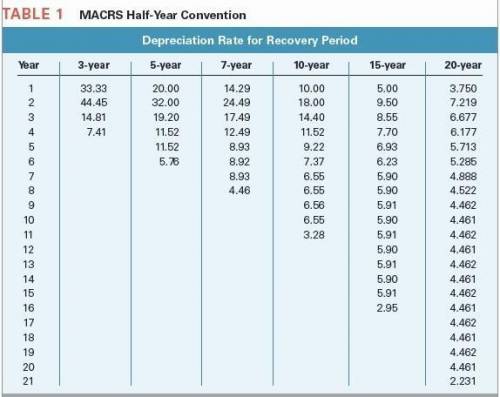

A project has equipment requirements that will cost $150,000 installed. NWC of $50,000 will also be required. The project is replacing old equipment that can be sold for $25,000, book value 0. Assume that the equipment will be depreciated as a 3-year asset under MACRS. The useful life is 5 years with a 40% tax rate.

a. What is the NINV for the project? Calculate the depreciation for each of the 5 years of the asset’s life.

b. Assume the FCF for the project is $95,000 per year for 5 years. Calculate the NPV, IRR, MIRR, and PI for the project if your required discount rate is 12%?

Answers: 2

Another question on Business

Business, 21.06.2019 18:10

In a sumif conditional function, what should be the order of terms in the parentheses?

Answers: 1

Business, 21.06.2019 22:50

He taylor company sells music systems. each music system costs the company $100 and will be sold to the public for $250. in year one, the company sells 100 gift cards to customers for $250 each ($25,000 in total). these cards are valid for just one year, and company officials expect them to all be redeemed. in year two, only 96 of the cards are returned. what amount of net income does the company report for year two in connection with these cards? a. $15,000b. $15,400c. $15,500d. $15,800

Answers: 1

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 14:20

In canada, the reference base period for the cpi is 2002. by 2012, prices had risen by 21.6 percent since the base period. the inflation rate in canada in 2013 was 1.1 percent. calculate the cpi in canada in 2013. hint: use the information that “prices had risen by 21.6 percent since the base period” to find the cpi in 2012. use the inflation rate formula (inflation is the growth rate of the cpi) to find cpi in 2013, knowing the cpi in 2012 and the inflation rate. the cpi in canada in 2013 is round up your answer to the first decimal. 122.9 130.7 119.6 110.5

Answers: 1

You know the right answer?

A project has equipment requirements that will cost $150,000 installed. NWC of $50,000 will also be...

Questions

English, 03.05.2020 12:49

Social Studies, 03.05.2020 12:49

Mathematics, 03.05.2020 12:49

English, 03.05.2020 12:49

Mathematics, 03.05.2020 12:49

Mathematics, 03.05.2020 12:49

History, 03.05.2020 12:49

Mathematics, 03.05.2020 12:49

English, 03.05.2020 12:49

Mathematics, 03.05.2020 12:49

Mathematics, 03.05.2020 12:49

History, 03.05.2020 12:49