Business, 10.03.2022 08:50 raulriquelmef6p0947w

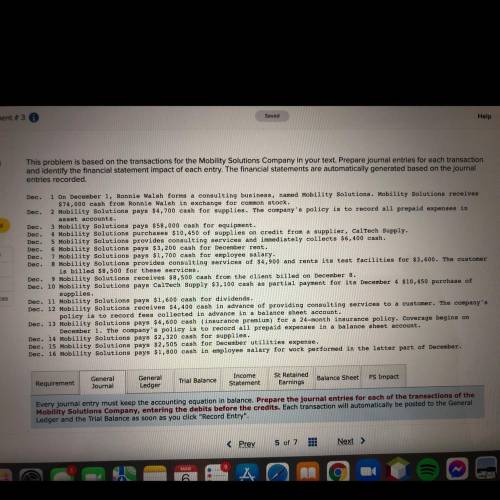

This problem is based on the transactions for the Mobility Solutions Company in your text. Prepare journal entries for each transaction

and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal

entries recorded.

Dec.

Dec. 1 On December 1, Ronnie Walsh forms a consulting business, named Mobility Solutions. Mobility Solutions receives

$74,000 cash from Ronnie Walsh in exchange for common stock.

2 Mobility Solutions pays $4,700 cash for supplies. The company's policy is to record all prepaid expenses in

asset accounts.

Dec. 3 Mobility Solutions pays $58,000 cash for equipment.

Dec. 4 Mobility Solutions purchases $10,450 of supplies on credit from a supplier, CalTech Supply.

Dec. 5 Mobility Solutions provides consulting services and immediately collects $6,400 cash.

Dec. 6 Mobility Solutions pays $3,200 cash for December rent.

Dec. 7 Mobility Solutions pays $1,700 cash for employee salary.

Dec. 8 Mobility Solutions provides consulting services of $4,900 and rents its test facilities for $3,600. The customer

is billed $8,500 for these services.

Dec. 9 Mobility Solutions receives $8,500 cash from the client billed on December 8.

Dec. 10 Mobility Solutions pays CalTech Supply $3,100 cash as partial payment for its December 4 $10,450 purchase of

supplies.

Dec. 11 Mobility Solutions pays $1,600 cash for dividends.

Dec. 12 Mobility Solutions receives $4,400 cash in advance of providing consulting services to a customer. The company's

policy is to record fees collected in advance in a balance sheet account.

Dec. 13 Mobility Solutions pays $4,600 cash (insurance premium) for a 24-month insurance policy. Coverage begins on

December 1. The company's policy is to record all prepaid expenses in a balance sheet account.

Dec. 14 Mobility Solutions pays $2,320 cash for supplies.

Dec. 15 Mobility Solutions pays $2,505 cash for December utilities expense.

Dec. 16 Mobility Solutions pays $1,800 cash in employee salary for work performed in the latter part of December.

Answers: 2

Another question on Business

Business, 22.06.2019 14:50

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

Business, 22.06.2019 19:00

1. regarding general guidelines for the preparation of successful soups, which of the following statements is true? a. thick soups made with starchy vegetables may thin during storage. b. soups should be seasoned throughout the cooking process. c. finish a cream soup well before serving it to moderate the flavor. d. consommés take quite a long time to cool.

Answers: 2

Business, 22.06.2019 20:20

Reynolds corp. factors $400,000 of accounts receivable with mateer finance corporation on a without recourse basis on july 1, 2015. the receivables records are transferred to mateer finance, which will receive the collections. mateer finance assesses a finance charge of 1 ½ percent of the amount of accounts receivable and retains an amount equal to 4% of accounts receivable to cover sales discounts, returns, and allowances. the transaction is to be recorded as a sale.required: a. prepare the journal entry on july 1, 2015, for reynolds corp. to record the sale of receivables without recourse.b. prepare the journal entry on july 1, 2015, for mateer finance corporation to record the purchase of receivables without recourse— think through this.c. explain the difference between sale of receivables with recourse as oppose to without recourse.

Answers: 2

You know the right answer?

This problem is based on the transactions for the Mobility Solutions Company in your text. Prepare j...

Questions

Mathematics, 21.06.2019 18:00

Computers and Technology, 21.06.2019 18:00

Chemistry, 21.06.2019 18:00

Chemistry, 21.06.2019 18:00

History, 21.06.2019 18:00

History, 21.06.2019 18:00

Mathematics, 21.06.2019 18:00

Social Studies, 21.06.2019 18:00

History, 21.06.2019 18:00

Physics, 21.06.2019 18:00

Chemistry, 21.06.2019 18:00

English, 21.06.2019 18:00

Health, 21.06.2019 18:00

English, 21.06.2019 18:00

Mathematics, 21.06.2019 18:00