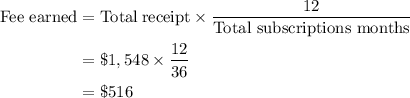

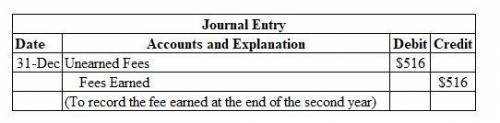

On april 1, griffith publishing company received $1,548 from santa fe, inc. for 36-month subscriptions to several different magazines. the company credited unearned fees for the amount received and the subscriptions started immediately. assuming adjustments are only made at year-end, what is the adjusting entry that should be recorded by griffith publishing company on december 31 of the second year?

Answers: 1

Another question on Business

Business, 21.06.2019 17:30

You want to paint your room yellow, so you get some samples at the paint store. when you hold the sample against your white wall, it looks different from the way it looks against the green curtain. a psychologist would attribute this to perceptual constancy. visual paradoxes. contrast effects. threshold differences.

Answers: 3

Business, 22.06.2019 14:50

The following information is needed to reconcile the cash balance for gourmet catering services. * a deposit of $5,600 is in transit. * outstanding checks total $1,000. * the book balance is $6,400 at february 28, 2019. * the bookkeeper recorded a $1,800 check as $17,200 in payment of the current month's rent. * the bank balance at february 28, 2019 was $17,410. * a deposit of $400 was credited by the bank for $4,000. * a customer's check for $3,300 was returned for nonsufficient funds. * the bank service charge is $90. what was the adjusted book balance?

Answers: 1

Business, 22.06.2019 17:00

Which represents a surplus in the market? a market price equals equilibrium price. b quantity supplied is greater than quantity demanded. c market price is less than equilibrium price. d quantity supplied equals quantity demanded.

Answers: 2

Business, 22.06.2019 17:40

Slimwood corporation made sales of $ 725 million during 2018. of this amount, slimwood collected cash for $ 670 million. the company's cost of goods sold was $ 300 million, and all other expenses for the year totaled $ 400 million. also during 2018, slimwood paid $ 420 million for its inventory and $ 285 million for everything else. beginning cash was $ 110 million. carter's top management is interviewing you for a job and they ask two questions: (a) how much was carter's net income for 2018? (b) how much was carter's cash balance at the end of 2016? you will get the job only if you answer both questions correctly.

Answers: 1

You know the right answer?

On april 1, griffith publishing company received $1,548 from santa fe, inc. for 36-month subscriptio...

Questions

Chemistry, 03.02.2021 23:00

History, 03.02.2021 23:00

Mathematics, 03.02.2021 23:00

Mathematics, 03.02.2021 23:00

Mathematics, 03.02.2021 23:00

Mathematics, 03.02.2021 23:00

Mathematics, 03.02.2021 23:00

Mathematics, 03.02.2021 23:00

Mathematics, 03.02.2021 23:00

Mathematics, 03.02.2021 23:00

Physics, 03.02.2021 23:00