Business, 25.07.2019 11:50 meramera50

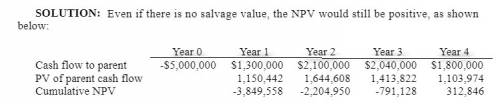

Assume that baps corporation is considering the establishment of a subsidiary in norway. the initial investment required by the parent is $5,000,000. if the project is undertaken, baps would terminate the project after four years. baps' cost of capital is 13%, and the project is of the same risk as baps' existing projects. all cash flows generated from the project will be remitted to the parent at the end of each year. listed below are the estimated cash flows the norwegian subsidiary will generate over the project's lifetime in norwegian kroner (nok): the current exchange rate of the norwegian kroner is $0.135. baps' exchange rate forecast for the norwegian kroner over the project's lifetime is listed below: baps believes that nok8,000,000 of the cash flow in year 4 is a fair estimate of the project's salvage value, so that the cash flow in year 4 is nok12,000,000 without the salvage value. however, baps realizes that the salvage value may be different from nok8,000,000 and wishes to determine the break-even salvage value, which is

Answers: 1

Another question on Business

Business, 22.06.2019 01:20

All of the industries and businesses in the country of marksenia are privately owned and sell products at different prices that are not controlled by the government or any other organizational body. consumers in marksenia are free to buy as much of the products as they like from the businesses they want. the country of marksenia has a

Answers: 1

Business, 22.06.2019 11:00

You are attending college in the fall and you need to purchase a computer. you must finance the purchase because your parents will not purchase it for you, and you do not have the cash on hand to purchase it. in blank #1 determine which type of credit would you use to finance your purchase (installment, non-installment, or revolving credit). (2 points) in blank #2 defend your credit choice by explaining why your financing option is the best option for you. (2 points) in blank #3 explain why you selected that credit option over the other two options available. (2 points)

Answers: 3

Business, 22.06.2019 16:10

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

Business, 22.06.2019 21:10

You are the manager of a large crude-oil refinery. as part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material flowing through it) must be replaced every year. the replacement and downtime cost in the first year is $165 comma 000. this cost is expected to increase due to inflation at a rate of 7% per year for six years (i.e. until the eoy 7), at which time this particular heat exchanger will no longer be needed. if the company's cost of capital is 15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Answers: 1

You know the right answer?

Assume that baps corporation is considering the establishment of a subsidiary in norway. the initial...

Questions

Health, 16.07.2019 04:30

Health, 16.07.2019 04:30

History, 16.07.2019 04:30

Mathematics, 16.07.2019 04:30

World Languages, 16.07.2019 04:30