Computers and Technology, 08.10.2020 09:01 twrxght6643

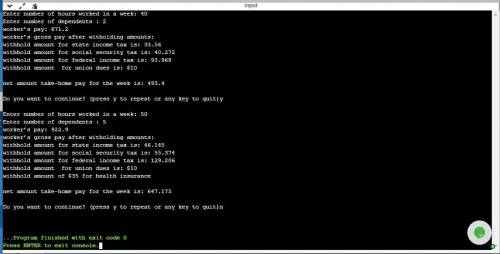

An employee is paid at a rate of $16.78 per hour for the first 40 hours worked in a week. Any hours over that are paid at the overtime rate of oneand-one-half times that. From the worker’s gross pay, 6% is withheld for Social Security tax, 14% is withheld for federal income tax, 5% is withheld for state income tax, and $10 per week is withheld for union dues. If the worker has three or more dependents, then an additional $35 is withheld to cover the extra cost of health insurance beyond what the employer pays. Write a program that will read in the number of hours worked in a week and the number of dependents as input and will then output the worker’s gross pay, each withholding amount, and the net take-home pay for the week. For a harder version, write your program so that it allows the calculation to be repeated as often as the user wishes. If this is a class exercise, ask your instructor whether you should do this harder version.

Answers: 3

Another question on Computers and Technology

Computers and Technology, 23.06.2019 23:30

A. in packet tracer, only the server-pt device can act as a server. desktop or laptop pcs cannot act as a server. based on your studies so far, explain the client-server model.

Answers: 2

Computers and Technology, 24.06.2019 06:30

Me and category do i put them in because this is science

Answers: 1

Computers and Technology, 24.06.2019 20:30

⭐️⭐️⭐️ what network is larger in size? man or wan? you ⭐️⭐️⭐️

Answers: 2

Computers and Technology, 24.06.2019 23:00

Aselect query joins tables together by their a. table names. b. primary keys. c. first entries. d. field names.

Answers: 2

You know the right answer?

An employee is paid at a rate of $16.78 per hour for the first 40 hours worked in a week. Any hours...

Questions

Mathematics, 21.08.2019 09:30

History, 21.08.2019 09:30

Mathematics, 21.08.2019 09:30

Biology, 21.08.2019 09:30

History, 21.08.2019 09:30

Health, 21.08.2019 09:30

History, 21.08.2019 09:30

Chemistry, 21.08.2019 09:30

History, 21.08.2019 09:30

Mathematics, 21.08.2019 09:30

Mathematics, 21.08.2019 09:30

Computers and Technology, 21.08.2019 09:30

History, 21.08.2019 09:30