Please help, im very confused.

A certain state uses the following progressive

tax rate for ca...

Law, 30.03.2021 21:20 hernandezaniyah660

Please help, im very confused.

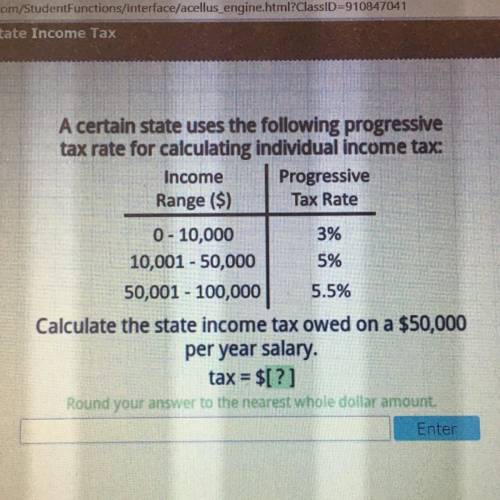

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 10,000

3%

10,001 - 50,000 5%

50,001 - 100,000 5.5%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 1

Another question on Law

Law, 03.07.2019 15:10

Which of the following is not a major type of cybercrime reported to the ic3? a. government impersonation scams b. advance fee fraud c. identity theft d. malware fraud

Answers: 1

Law, 06.07.2019 06:20

Acash payment of $1 given to support a gift promise cannot support a contract. true false

Answers: 1

Law, 06.07.2019 11:10

Vop hearing iowa 2 tec violation discharge date expired tho can they send me to jail?

Answers: 3

Law, 07.07.2019 05:10

47. when must a driver show proof of financial responsibility? a. when requested by a police office b. to register a vehicle or renew its registration c. to obtain a drivers education certificate d. both a and b

Answers: 1

You know the right answer?

Questions

SAT, 01.08.2021 06:00

Mathematics, 01.08.2021 06:00

Mathematics, 01.08.2021 06:10

Mathematics, 01.08.2021 06:10

English, 01.08.2021 06:10

English, 01.08.2021 06:10

Mathematics, 01.08.2021 06:10

Mathematics, 01.08.2021 06:10

Mathematics, 01.08.2021 06:10

Mathematics, 01.08.2021 06:10

Mathematics, 01.08.2021 06:10

Biology, 01.08.2021 06:10

Mathematics, 01.08.2021 06:10