Mathematics, 04.07.2019 05:30 cesar566

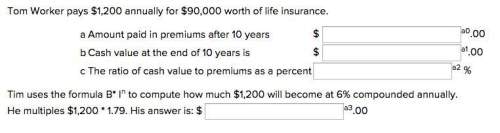

Ineed your ! will give brainiest! a person filing his federal income tax return with the single filing status had a taxable income of $168,050. according to the table below, how much of that income will he have left over after paying his federal income tax. a. $144,026.00 b. $24,024.00 c. $127,276.00 d. $40,774.00

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 14:50

Which best describes the strength of the correlation, and what is true about the causation between the variables? it is a weak negative correlation, and it is not likely causal. it is a weak negative correlation, and it is likely causal. it is a strong negative correlation, and it is not likely causal. it is a strong negative correlation, and it is likely causal.

Answers: 1

Mathematics, 21.06.2019 20:00

Landon wrote that 3−2.6=4. which statement about his answer is true?

Answers: 1

Mathematics, 21.06.2019 23:00

What is the location of point g, which partitions the directed line segment from d to f into a 5: 4 ratio? –1 0 2 3

Answers: 1

Mathematics, 22.06.2019 00:30

Pls as soon as ! will award brainliest and 20 ! also the answer is not 22.5 degrees! find the value of x in each case:

Answers: 3

You know the right answer?

Ineed your ! will give brainiest! a person filing his federal income tax return with the single f...

Questions

Mathematics, 17.02.2021 07:10

Chemistry, 17.02.2021 07:10

Mathematics, 17.02.2021 07:10

Mathematics, 17.02.2021 07:10

History, 17.02.2021 07:10

Chemistry, 17.02.2021 07:10

Mathematics, 17.02.2021 07:10

Mathematics, 17.02.2021 07:10

Mathematics, 17.02.2021 07:10

Mathematics, 17.02.2021 07:10

English, 17.02.2021 07:10

Mathematics, 17.02.2021 07:10

Physics, 17.02.2021 07:10

History, 17.02.2021 07:10

History, 17.02.2021 07:10

Mathematics, 17.02.2021 07:10