Mathematics, 26.06.2019 01:20 lauraabosi

Raquel has gross pay of $732 and federal tax withholdings of $62. determine raquel’s net pay if she has the additional items withheld: social security tax that is 6.2% of her gross pay medicare tax that is 1.45% of her gross pay state tax that is 21% of her federal tax a. $600.99 b. $610.54 c. $641.83 d. $662.99

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:30

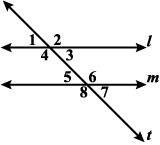

Can someone me out here and the tell me the greatest common factor

Answers: 1

Mathematics, 21.06.2019 19:00

There is an entrance to the computer room at point e which lies on ab and is 5 feet from point a. plot point e on the coordinate plane. find the distance from the entrance at point e to the printer at point e

Answers: 1

Mathematics, 21.06.2019 20:30

25) 56(1) = 5b a. identity property of addition b. identity property of multiplication c. commutative property of multiplication d. commutative property of addition

Answers: 1

You know the right answer?

Raquel has gross pay of $732 and federal tax withholdings of $62. determine raquel’s net pay if she...

Questions

Social Studies, 26.07.2019 10:30

History, 26.07.2019 10:30

History, 26.07.2019 10:30

Mathematics, 26.07.2019 10:30

Chemistry, 26.07.2019 10:30