Mathematics, 25.06.2019 14:00 cdyshaylia55

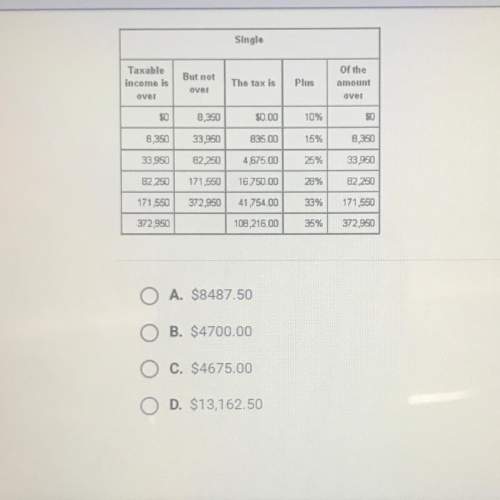

Porter had a taxable income of $34,050 and filed his federal income tax return with the single filing status. using the table below find the amount he has to pay in taxes.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:30

After being rearranged and simplified, which of the following equations could be solved using the quadratic formula? check all that apply. a. 9% + 3x2 = 14 + x-1 b. -x+ + 4x + 7 = -32-9 c. 5x + 4 = 3x4 - 2 d. 2x2 + x2 + x = 30

Answers: 1

Mathematics, 21.06.2019 16:30

Arandom sample of 150 high school students were asked whether they have a job. the results are shown in the table. have a job do not have a job male 48 35 female 41 26 select a ord or phrase from the drop-down menus to correctly complete the statements describing the association.

Answers: 1

Mathematics, 21.06.2019 19:50

Examine the two-step equation. − 7 4 + x 4 = 2 which property of operations allows you to add the same constant term to both sides? amultiplication property of equality bdivision property of equality caddition property of equality dsubtraction property of equality

Answers: 2

Mathematics, 21.06.2019 20:00

Which type of graph would allow us to compare the median number of teeth for mammals and reptiles easily

Answers: 2

You know the right answer?

Porter had a taxable income of $34,050 and filed his federal income tax return with the single filin...

Questions

Mathematics, 29.12.2019 16:31

English, 29.12.2019 16:31

History, 29.12.2019 16:31

Social Studies, 29.12.2019 16:31

Health, 29.12.2019 16:31

Mathematics, 29.12.2019 16:31

Health, 29.12.2019 16:31

Chemistry, 29.12.2019 16:31

Mathematics, 29.12.2019 16:31

Mathematics, 29.12.2019 16:31