Mathematics, 19.08.2019 18:10 ToonGamesToo

You are considering the purchase of a common stock that paid a dividend of $2.00 yesterday. you expect this stock to have a growth rate of 15 percent for the next 3 years, resulting in dividends of upper d 1 equals $ 2.30, upper d 2 equals $ 2.645, and d3 = $3.04. the longminusrun normal growth rate after year 3 is expected to be 10 percent (that is, a constant growth rate after year 3 of 10% per year forever). if you require a 14 percent rate of return, how much should you be willing to pay for this stock?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:40

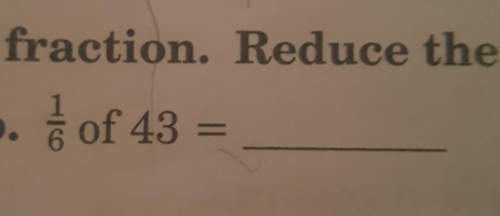

Solve the equation below: (x+4)/6x=1/x a. x=2 b. x=0,2 c. x=-2 d. x=0,-2

Answers: 1

Mathematics, 21.06.2019 19:30

The pyramid below was dissected by a horizontal plane which shape describes the pyramid horizontal cross section

Answers: 1

Mathematics, 21.06.2019 23:30

An engineer scale model shows a building that is 3 inches tall. if the scale is 1 inch = 600 feet, how tall is the actual building?

Answers: 3

Mathematics, 22.06.2019 02:00

Find a third-degree polynomial equation with rational coefficients that has roots -2 and 6+i

Answers: 2

You know the right answer?

You are considering the purchase of a common stock that paid a dividend of $2.00 yesterday. you expe...

Questions

Mathematics, 19.04.2021 18:40

Mathematics, 19.04.2021 18:40

History, 19.04.2021 18:40

Mathematics, 19.04.2021 18:40

Mathematics, 19.04.2021 18:40

Mathematics, 19.04.2021 18:40

Arts, 19.04.2021 18:50

English, 19.04.2021 18:50

History, 19.04.2021 18:50

Mathematics, 19.04.2021 18:50

Spanish, 19.04.2021 18:50

Mathematics, 19.04.2021 18:50