Mathematics, 16.10.2019 05:00 aliw03

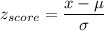

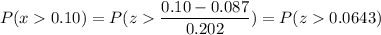

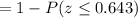

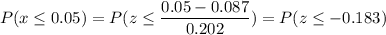

Andrew plans to retire in 40 years. he plans to invest part of his retirement funds in stocks, so he seeks out information on past returns. he learns that over the entire 20th century, the real (that is, adjusted for inflation) annual returns on u. s. common stocks had mean 8.7% and standard deviation 20.2%. the distribution of annual returns on common stocks is roughly symmetric, so the mean return over even a moderate number of years is close to normal. what is the probability (assuming that the past pattern of variation continues) that the mean annual return on common stocks over the next 40 years will exceed 10%? what is the probability that the mean return will be less than 5%? write a conclusion in the context of the problem.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:00

Look at arnold's attempt to solve the equation for b: 3b = 12 b = 3 · 12 b = 36 describe the mistake that arnold made.

Answers: 2

Mathematics, 21.06.2019 18:30

You receive 15% of the profit from a car wash how much money do you receive from a profit of 300

Answers: 2

Mathematics, 21.06.2019 20:30

What is the interquartile range of this data set? 2, 5, 9, 11, 18, 30, 42, 48, 55, 73, 81

Answers: 1

Mathematics, 22.06.2019 00:20

Match the following reasons with the statements given to create the proof. 1. do = ob, ao = oc sas 2. doc = aob given 3. triangle cod congruent to triangle aob vertical angles are equal. 4. 1 = 2, ab = dc if two sides = and ||, then a parallelogram. 5. ab||dc if alternate interior angles =, then lines parallel. 6. abcd is a parallelogram cpcte

Answers: 2

You know the right answer?

Andrew plans to retire in 40 years. he plans to invest part of his retirement funds in stocks, so he...

Questions

Chemistry, 26.06.2019 11:30

Mathematics, 26.06.2019 11:30

Business, 26.06.2019 11:30

Chemistry, 26.06.2019 11:30

Chemistry, 26.06.2019 11:30

Mathematics, 26.06.2019 11:30

English, 26.06.2019 11:30

Physics, 26.06.2019 11:30

English, 26.06.2019 11:30