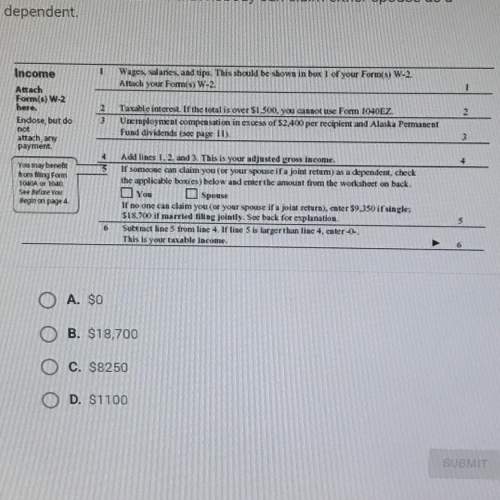

According to the income section shown below from the 1040ez form, in

married couple filing the...

Mathematics, 08.11.2019 19:31 cjdolce9790

According to the income section shown below from the 1040ez form, in

married couple filing their federal income tax return jointly enters 817,600 on

line 4 for adjusted gross income, what would they enter on line 6 for their

taxable income? assume that nobody can claim either spouse as a

dependent

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:00

1) what is the measure of the exterior angle, ∠uvw ? 2) in triangle man, what is the measure of the exterior angle at n (in degrees)?

Answers: 1

Mathematics, 21.06.2019 20:30

Asmall business produces and sells balls. the fixed costs are $20 and each ball costs $4.32 to produce. each ball sells for $8.32. write the equations for the total cost, c, and the revenue, r, then use the graphing method to determine how many balls must be sold to break even.

Answers: 1

Mathematics, 21.06.2019 23:00

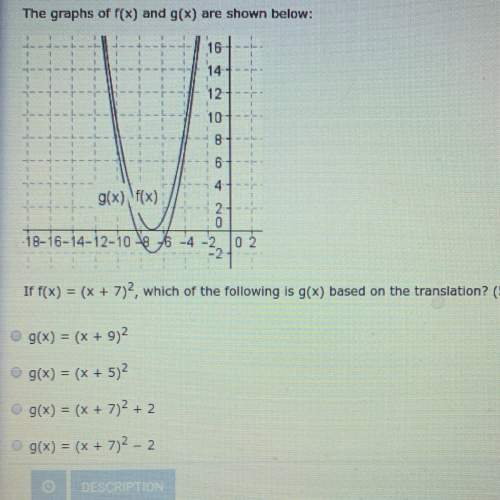

Could someone me with this question i’ve been stuck on it for 20 minutes

Answers: 1

Mathematics, 22.06.2019 00:00

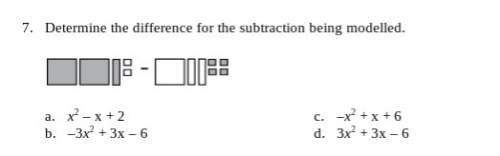

Subtract and simplify. (-y^2 – 4y - 8) – (-4y^2 – 6y + 3) show how you got the answer if your answer is right i will mark you

Answers: 1

You know the right answer?

Questions

Mathematics, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

History, 07.05.2021 01:00

Computers and Technology, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00

History, 07.05.2021 01:00

Mathematics, 07.05.2021 01:00