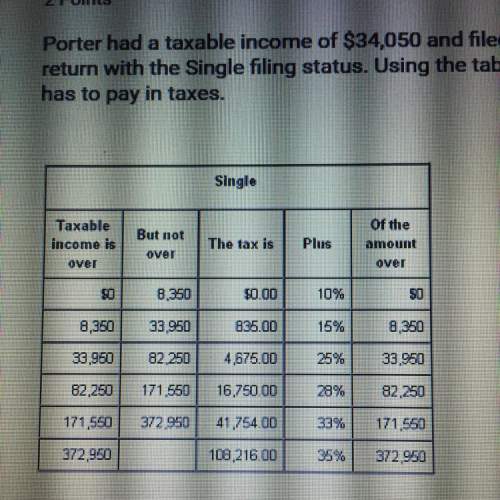

Porter had a taxable income of $34,050 and filed his federal income tax

return with the single...

Mathematics, 12.11.2019 03:31 beccakubas

Porter had a taxable income of $34,050 and filed his federal income tax

return with the single filing status. using the table below find the amount he

has to pay in taxes.

a. $8487.50

b. $4675.00

c. $13,162.50

d. $4700.00

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:00

What value of x will make the triangles similar by the sss similarity theorem?

Answers: 3

Mathematics, 21.06.2019 16:00

You decide instead to take the train there. the train will take 135 minutes. convert this into hours and minutes.

Answers: 2

Mathematics, 21.06.2019 17:30

Terri makes a quilt using three sizes of fabric squares the side lenght of each fabric square is the square root of the area

Answers: 2

You know the right answer?

Questions

Biology, 02.07.2019 20:30

History, 02.07.2019 20:30

Mathematics, 02.07.2019 20:30

Mathematics, 02.07.2019 20:30

Biology, 02.07.2019 20:30

English, 02.07.2019 20:30

Mathematics, 02.07.2019 20:30

Mathematics, 02.07.2019 20:30

Mathematics, 02.07.2019 20:30

Mathematics, 02.07.2019 20:30

History, 02.07.2019 20:30