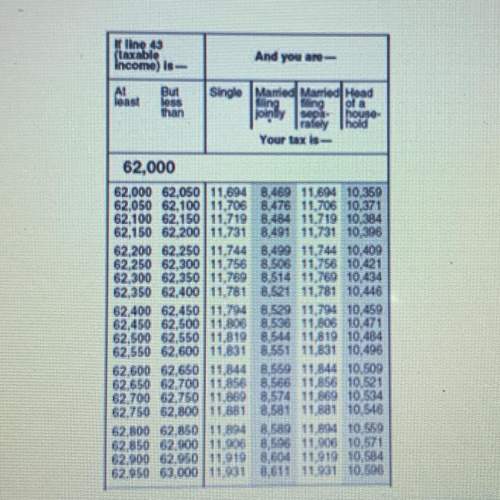

Mallory's taxable income last year was $62,800. according to the tax table

below, how much tax...

Mathematics, 20.11.2019 21:31 lelseymota123

Mallory's taxable income last year was $62,800. according to the tax table

below, how much tax does she have to pay if she files with the "single"

status?

a. $11,894

b. $10,559

c. $8589

d. $11,881

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 12:30

What basic trigonometric identity would you use to verify that sin x cos x tan x =1-cos^(2)x?

Answers: 2

Mathematics, 21.06.2019 21:20

Se tiene en una caja de canicas 10, 4 blancas y 6 negras ¿cual es la probabilidad que en 2 extracciones con reemplazo sean blancas? ¿cual es la probalidad que en 2 extracciones sin reemplazo sean negras?

Answers: 1

Mathematics, 21.06.2019 23:40

In the diagram, a building cast a 35-ft shadow and a flagpole casts an 8-ft shadow. if the the flagpole is 18 ft tall, how tall is the building? round the the nearest tenth.

Answers: 2

You know the right answer?

Questions

Business, 06.12.2021 21:20

Mathematics, 06.12.2021 21:20

Biology, 06.12.2021 21:20

Social Studies, 06.12.2021 21:20

Mathematics, 06.12.2021 21:20

Biology, 06.12.2021 21:20

Mathematics, 06.12.2021 21:20

Mathematics, 06.12.2021 21:20

Mathematics, 06.12.2021 21:20

Computers and Technology, 06.12.2021 21:20