Mathematics, 26.11.2019 19:31 ShilohTheBoy

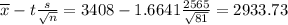

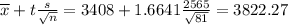

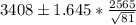

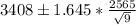

In a random sample of 81 audited estate tax returns, it was determined that the mean amount of additional tax owed was $3408 with a standard deviation of $2565. construct and interpret a 90% confidence interval for the mean additional amount of tax owed for estate tax returns. the lower bound is $ nothing. (round to the nearest cent as needed.) the upper bound is $ nothing. (round to the nearest cent as needed.) interpret a 90% confidence interval for the mean additional amount of tax owed for estate tax returns. choose the correct answer below.

a. one can be 90% confident that the mean additional tax owed is less than the lower bound

b. one can be 90% confident that the mean additional tax owed is between the lower and upper bounds

c. one can be 90% confident that the mean additional tax owed is greater than the upper bound.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 14:40

3× __ -2=15 7 2× __+1=7 5 7× =22 15 5× __+10=2 8 × __+4=20 6 × =10 3 × __+2=8 6 × __+8=8 9 × __+7=20 6

Answers: 3

Mathematics, 21.06.2019 15:00

What is the value with a place of tenths in 907.456 1) 0 2) 6 3) 4 4) 5

Answers: 1

Mathematics, 21.06.2019 16:00

Will give brainliest what is the value of x? enter your answer in the box.

Answers: 1

Mathematics, 21.06.2019 19:50

Which statement is true? n is a point of tangency on circle p. pt is a secant of circle p. is a secant of circle p. vu is a tangent of circle p.

Answers: 3

You know the right answer?

In a random sample of 81 audited estate tax returns, it was determined that the mean amount of addit...

Questions

Mathematics, 27.09.2019 23:50

History, 27.09.2019 23:50

Physics, 27.09.2019 23:50

Mathematics, 27.09.2019 23:50

Advanced Placement (AP), 27.09.2019 23:50

English, 27.09.2019 23:50

Mathematics, 27.09.2019 23:50

History, 27.09.2019 23:50

Chemistry, 27.09.2019 23:50

Mathematics, 27.09.2019 23:50

Mathematics, 27.09.2019 23:50

Mathematics, 28.09.2019 00:00

.

.

.

.

.

.