Mathematics, 05.12.2019 21:31 alyssarene16

Randall had an agi of $45,000. he had $1500 in medical expenses, paid

$1356 in mortgage interest, and drove a company car for work. which

expense(s) can he itemize on his tax return?

a. medical expenses and nonreimbursed work expenses.

o

b. mortgage interest only

c. mortgage interest and medical expenses

d. nonreimbursed work expenses, mortgage interest, and medical

expenses

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:40

How many square feet of out door carpet will we need for this hole? 8ft 3ft 12ft 4ft

Answers: 1

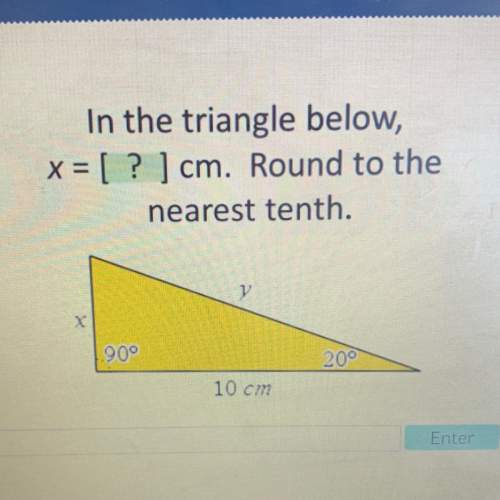

Mathematics, 22.06.2019 00:00

When a 757 passenger jet begins its descent to the ronald reagan national airport in washington, d.c., it is 3900 feet from the ground. its angle of descent is 6 degrees. how far must the plane fly to reach the run way? a. 37,106 ft b. 37,310.4 ft c. 23,456.6 ft d 2,492.7 ft

Answers: 2

Mathematics, 22.06.2019 01:00

Bc and bd are opposite rays. all of the following are true except a)a,b,c,d are collinear b)a,b,c,d are coplanar c)bc=bd d)b is between c and d

Answers: 1

Mathematics, 22.06.2019 01:00

Given the net of the rectangular prism, what is its surface area?

Answers: 1

You know the right answer?

Randall had an agi of $45,000. he had $1500 in medical expenses, paid

$1356 in mortgage intere...

$1356 in mortgage intere...

Questions

History, 26.09.2019 23:10

Mathematics, 26.09.2019 23:10

Mathematics, 26.09.2019 23:10

History, 26.09.2019 23:10

Mathematics, 26.09.2019 23:10

Mathematics, 26.09.2019 23:10

Mathematics, 26.09.2019 23:10

Biology, 26.09.2019 23:10