Mathematics, 18.01.2020 13:31 Nicolegrove7927

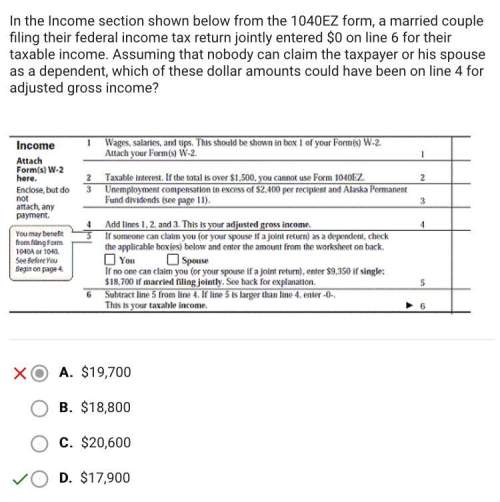

In the income section shown below from the 1040ez form, a married couple filing their federal income tax return jointly entered $0 on line 6 for their taxable income. assuming that nobody can claim the taxpayer or his spouse as a dependent, which of these dollar amounts could have been on line 4 for adjusted gross income?

$17,900

Answers: 1

Another question on Mathematics

Mathematics, 20.06.2019 18:04

Achel bought 12 rolls of packing tape and paid a total of $33.60. kevin also bought rolls of packing tape. the table shows the total amount he is paid for different numbers of packing tape. number of rolls of packing tape total amount paid 2 $6.40 5 $16.00 8 $25.60 how do the unit rates compare? select from the drop-down menus to correctly complete the statement. rachel's unit rate is than kevin's because is greater than .

Answers: 3

Mathematics, 21.06.2019 20:50

Amanda went into the grocery business starting with five stores. after one year, she opened two more stores. after two years, she opened two more stores than the previous year. if amanda expands her grocery business following the same pattern, which of the following graphs represents the number of stores she will own over time?

Answers: 3

Mathematics, 22.06.2019 01:00

33 ! use the following data to determine the type of function (linear, quadratic, exponential) that best fits the data set. (1, 2) (5, 7) (9, 8) (3, 4) (4, 5) (2, 3)

Answers: 1

You know the right answer?

In the income section shown below from the 1040ez form, a married couple filing their federal income...

Questions

Mathematics, 07.11.2019 14:31

Biology, 07.11.2019 14:31

Biology, 07.11.2019 14:31

Chemistry, 07.11.2019 14:31

Mathematics, 07.11.2019 14:31

Social Studies, 07.11.2019 14:31

English, 07.11.2019 14:31

Social Studies, 07.11.2019 14:31

Biology, 07.11.2019 14:31

Mathematics, 07.11.2019 14:31

Mathematics, 07.11.2019 14:31

History, 07.11.2019 14:31