Mathematics, 20.01.2020 17:31 punkee5375

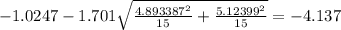

An investor believes that investing in domestic and international stocks will give a difference in the mean rate of return. they take two random samples of 15 months over the past 30 years and find the following rates of return from a selection of domestic (group 1) and international (group 2) investments. can they conclude that there is a difference at the 0.10 level of significance? assume the data is normally distributed with unequal variances. use a confidence interval method. round to 3 decimal places. average group 1 = 2.0233, sd group 1 = 4.893387, n1 = 15 average group 2 = 3.048, sd group 2 = 5.12399, n2 = 15

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:50

If you shift the linear parent function, f(x)=x, up 13 units, what is the equation of the new function?

Answers: 1

Mathematics, 22.06.2019 00:30

A10 inch cookie cake is divided into 8 slices. what is the area of 3 slices

Answers: 1

Mathematics, 22.06.2019 01:00

Astudent drew a circle and two secant segment. he concluded that if pq ~= ps, then qr ~= st. do you agree with the student’s conclusion? why or why not?

Answers: 1

You know the right answer?

An investor believes that investing in domestic and international stocks will give a difference in t...

Questions

Mathematics, 05.09.2020 20:01

Mathematics, 05.09.2020 20:01

Biology, 05.09.2020 20:01

Mathematics, 05.09.2020 20:01

Mathematics, 05.09.2020 20:01

represent the sample mean 1

represent the sample mean 1  represent the sample mean 2

represent the sample mean 2  population sample deviation for sample 1

population sample deviation for sample 1  population sample deviation for sample 2

population sample deviation for sample 2  parameter of interest at 0.1 of significance so the confidence would be 0.9 or 90%

parameter of interest at 0.1 of significance so the confidence would be 0.9 or 90%

(1)

(1)

and

and  , and we can use excel, a calculator or a table to find the critical value. The excel command would be: "=-T.INV(0.05,28)".And we see that

, and we can use excel, a calculator or a table to find the critical value. The excel command would be: "=-T.INV(0.05,28)".And we see that