Mathematics, 13.02.2020 02:08 sotelonancy888

Determine the total annual FICA tax for an annual salary of $110,330. Use $106,800 for maximum taxable earnings.

a.

$822.14

b.

$844.02

c.

$8,221.39

d.

$8,440.24

Determine the total annual FICA tax for an annual salary of $110,330. Use $106,800 for maximum taxable earnings.

a.

$822.14

b.

$844.02

c.

$8,221.39

d.

$8,440.24

A

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:30

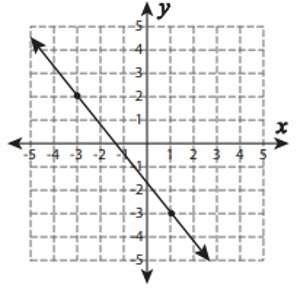

How do you use the elimination method for this question? explain, because i really want to understand!

Answers: 1

Mathematics, 21.06.2019 18:30

Suppose your school costs for this term were $4900 and financial aid covered 3/4 of that amount. how much did financial aid cover? and how much do you still have to pay?

Answers: 1

Mathematics, 22.06.2019 03:00

Which point on the scatter plot is an outlier? a scatter plot is show. point m is located at 3 and 3, point p is located at 5 and 5, point n is located at 5 and 7, point l is located at 6 and 2. additional points are located at 1 and 3, 2 and 3, 2 and 4, 3 and 4, 3 and 5, 4 and 5, 4 and 6, 5 and 6. point p point n point m point l

Answers: 3

Mathematics, 22.06.2019 03:30

If using the method of completing the square to solve the quadratic equation x 2 + 16 x + 24 = 0 x 2 +16x+24=0, which number would have to be added to "complete the square"?

Answers: 1

You know the right answer?

Determine the total annual FICA tax for an annual salary of $110,330. Use $106,800 for maximum taxab...

Questions

Computers and Technology, 03.03.2020 03:55

Mathematics, 03.03.2020 03:56