Mathematics, 28.02.2020 01:48 Graciesett4072

The value of an investment of $1000 earning 5% compounded annually is V(I, R) = 1000 1 + 0.05(1 − R) 1 + I^10 where I is the annual rate of inflation and R is the tax rate for the person making the investment.

a. Calculate VI(0.03, 0.28) and VR(0.03, 0.28).

b. Determine whether the tax rate or the rate of inflation is the greater "negative" factor in the growth of the investment.

i. The rate of inflation has the greater negative influence.

ii. The tax rate has the greater negative influence

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:30

Enter the missing numbers in the boxes to complete the table of equivalent ratios of lengths to widths. ? 18 8 ? 10 30 12 ?

Answers: 3

Mathematics, 21.06.2019 16:00

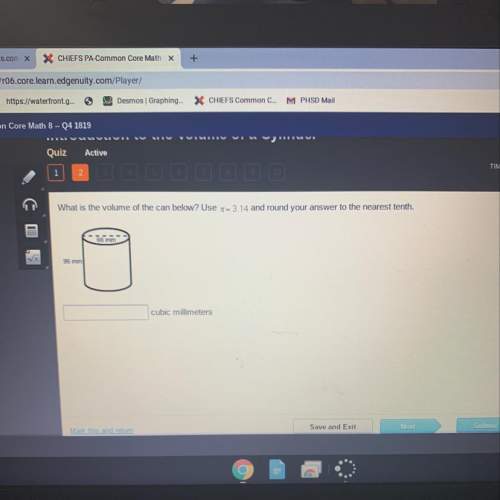

Three cylinders have a height of 8 cm. cylinder 1 has a radius of 1 cm. cylinder 2 has a radius of 2 cm. cylinder 3 has a radius of 3 cm. find the volume of each cylinder ( ! : ”0 )

Answers: 3

Mathematics, 21.06.2019 16:30

What is the name used to describe a graph where for some value of x, there exists 2 or more different values of y?

Answers: 2

You know the right answer?

The value of an investment of $1000 earning 5% compounded annually is V(I, R) = 1000 1 + 0.05(1 − R)...

Questions

Mathematics, 09.04.2020 07:53

English, 09.04.2020 07:53

Mathematics, 09.04.2020 07:53

Chemistry, 09.04.2020 07:53

Mathematics, 09.04.2020 07:53

Mathematics, 09.04.2020 07:53

English, 09.04.2020 07:53

Geography, 09.04.2020 07:53

Social Studies, 09.04.2020 07:53

History, 09.04.2020 07:53