Mathematics, 28.02.2020 20:16 julielebo8

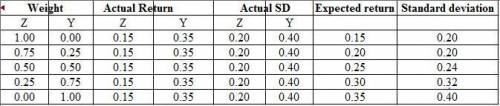

The expected returns and standard deviation of returns for two securities are as follows: Security Z Security Y Expected Return 15% 35% Standard Deviation 20% 40% The correlation between the returns is .25. (a) Calculate the expected return and standard deviation for the following portfolios: i. all in Z ii. .75 in Z and .25 in Y iii. .5 in Z and .5 in Y iv. .25 in Z and .75 in Y

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:00

The radius of the base of a cylinder is 10 centimeters, and its height is 20 centimeters. a cone is used to fill the cylinder with water. the radius of the cone's base is 5 centimeters, and its height is 10 centimeters.

Answers: 1

Mathematics, 21.06.2019 20:00

Which expression is rational? 6. , square root two, square root 14, square root 49

Answers: 1

Mathematics, 21.06.2019 20:00

Anature center offer 2 guided walks. the morning walk is 2/3 miles. the evening walk is 3/6 mile. which is shorter

Answers: 1

Mathematics, 22.06.2019 00:00

David leaves his house to go to school. he walks 200 meters west and 300 meters north. how far is david from his original starting point?

Answers: 1

You know the right answer?

The expected returns and standard deviation of returns for two securities are as follows: Security Z...

Questions

History, 31.08.2020 03:01

English, 31.08.2020 03:01

Mathematics, 31.08.2020 03:01

Physics, 31.08.2020 03:01

Mathematics, 31.08.2020 03:01

Computers and Technology, 31.08.2020 03:01

Computers and Technology, 31.08.2020 03:01

![E (return) = [W(Z)\times E(Z)]+[W(Y)\times E(Y)]](/tpl/images/0528/3761/aa45c.png)