Mathematics, 06.03.2020 05:54 g0606997

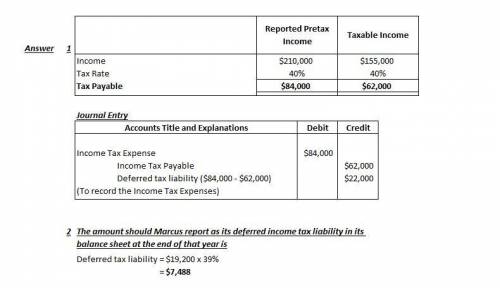

For its first year of operations, Marcus Corporation reported pretax accounting income of $274,800. However, because of a temporary difference in the amount of $19,200 relating to depreciation, taxable income is only $255,600. The tax rate is 39%. What amount should Marcus report as its deferred income tax liability in its balance sheet at the end of that year

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 16:30

Asequence {an} is defined recursively, with a1 = 1, a2 = 2 and, for n > 2, an = an-1 an-2 . find the term a241. a) 0 b) 1 c) 2 d) 1 2

Answers: 1

Mathematics, 21.06.2019 17:40

Which of the following are accepted without proof in a logical system? check all that apply.

Answers: 1

Mathematics, 21.06.2019 18:10

The means and mean absolute deviations of the individual times of members on two 4x400-meter relay track teams are shown in the table below. means and mean absolute deviations of individual times of members of 4x400-meter relay track teams team a team b mean 59.32 s 59.1 s mean absolute deviation 1.5 s 245 what percent of team b's mean absolute deviation is the difference in the means? 9% 15% 25% 65%

Answers: 2

You know the right answer?

For its first year of operations, Marcus Corporation reported pretax accounting income of $274,800....

Questions

Mathematics, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Biology, 19.05.2021 16:40

English, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Chemistry, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40

Mathematics, 19.05.2021 16:40