Mathematics, 16.03.2020 23:19 Tirone

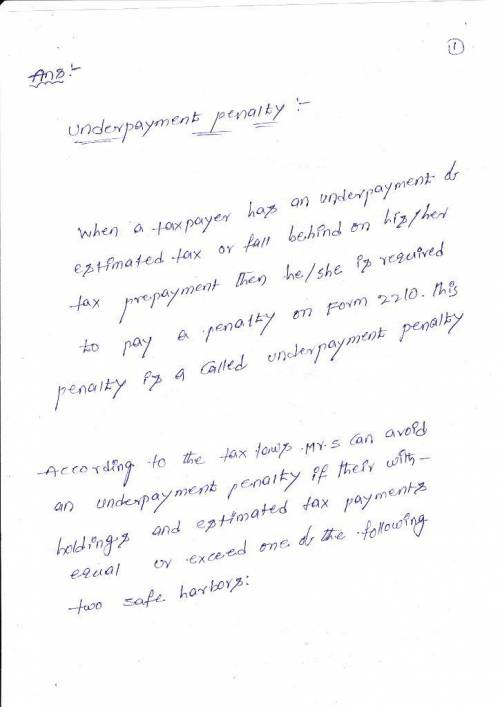

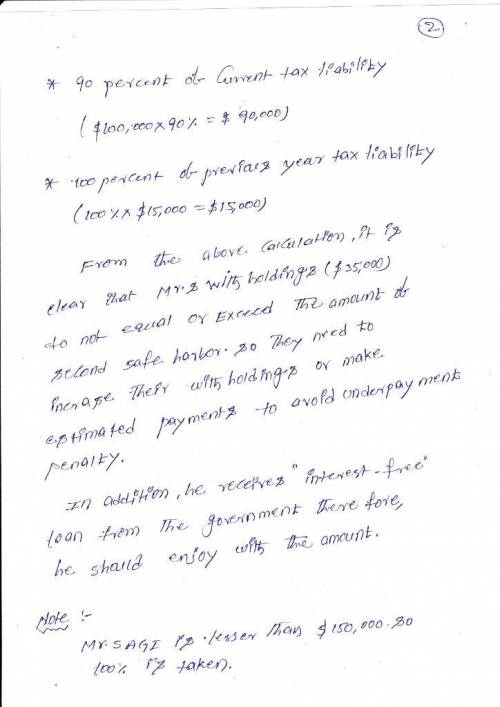

4. This year, Santhosh, a single taxpayer, estimates that his tax liability will be $100,000. Last year, his total tax liability was $15,000. He estimates that his tax withholding from his employer will be $35,000. Is Santhosh required to increase his withholding or make estimated tax payments this year to avoid the underpayment penalty? If so, how much?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 13:00

Sal is tiling his entryway. the floor plan is drawn on a unit grid. each unit length represents 1 foot. tile costs $1.35 per square foot. how much will sal pay to tile his entryway? round your answer to the nearest cent.

Answers: 2

Mathematics, 21.06.2019 18:00

Find the number of real number solutions for the equation. x2 + 5x + 7 = 0 0 cannot be determined 1 2

Answers: 2

Mathematics, 21.06.2019 18:30

What is the answer to this question? i'm a bit stumped. also how do i do it? 5(x - 4) = 2(x + 5)

Answers: 1

You know the right answer?

4. This year, Santhosh, a single taxpayer, estimates that his tax liability will be $100,000. Last y...

Questions

Biology, 02.04.2020 04:16

Health, 02.04.2020 04:16

Mathematics, 02.04.2020 04:17

Mathematics, 02.04.2020 04:17

Social Studies, 02.04.2020 04:17

Mathematics, 02.04.2020 04:17

Mathematics, 02.04.2020 04:17

Mathematics, 02.04.2020 04:17

Mathematics, 02.04.2020 04:17