Mathematics, 30.03.2020 17:20 janeou17xn

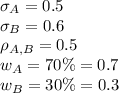

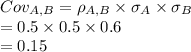

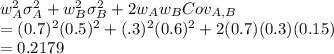

Stock A ‘s returns have a standard deviation of 0.5, and stock B’s returns have standard deviation of 0.6.The correlation coefficient between A and B equals 0.5. What is the variance of a portfolio composed of 70 percent Stock A and 30 percent Stock B?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 21:00

Which of the following is the best first step in solving the equation below? 4+2㏒³x=17

Answers: 1

Mathematics, 21.06.2019 22:10

Gravel is being dumped from a conveyor belt at a rate of 25 ft3/min, and its coarseness is such that it forms a pile in the shape of a cone whose base diameter and height are always equal. how fast is the height of the pile increasing when the pile is 14 ft high? (round your answer to two decimal places.) ft/min

Answers: 3

Mathematics, 22.06.2019 01:30

Drag the titles to the correct boxes to complete the pairs. the probability that kevin has diabetes and the test

Answers: 3

You know the right answer?

Stock A ‘s returns have a standard deviation of 0.5, and stock B’s returns have standard deviation o...

Questions

Mathematics, 11.07.2019 14:00

Health, 11.07.2019 14:00

Biology, 11.07.2019 14:00

English, 11.07.2019 14:00

Physics, 11.07.2019 14:00

Mathematics, 11.07.2019 14:00

Mathematics, 11.07.2019 14:00

Physics, 11.07.2019 14:00

Health, 11.07.2019 14:00

Mathematics, 11.07.2019 14:00

Mathematics, 11.07.2019 14:00