Mathematics, 30.03.2020 21:01 dariusardelean8700

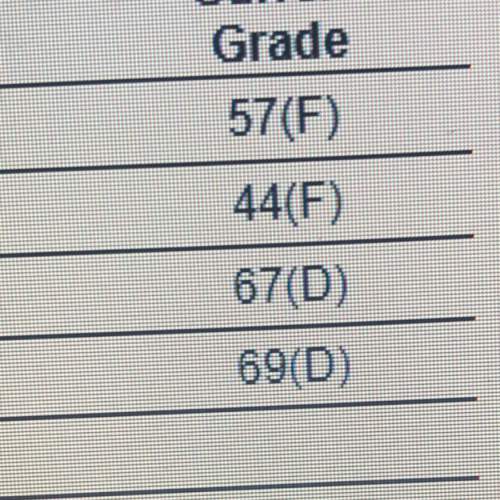

TKSC Company has one employee, Reba Shas. FICA Social Security taxes are 6.2% of the first $117,000 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For TKSC, its FUTA taxes are .6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 21:00

Kira looked through online census information to determine the overage number of people living in the homes in her city what is true about kira's data collection?

Answers: 1

Mathematics, 21.06.2019 21:50

Tamar is measuring the sides and angles of tuv to determine whether it is congruent to the triangle below. which pair of measurements would eliminate the possibility that the triangles are congruent

Answers: 1

Mathematics, 22.06.2019 00:00

City l has a temperature of −3 °f. city m has a temperature of −7 °f. use the number line shown to answer the questions: number line from negative 8 to positive 8 in increments of 1 is shown. part a: write an inequality to compare the temperatures of the two cities. (3 points) part b: explain what the inequality means in relation to the positions of these numbers on the number line. (4 points) part c: use the number line to explain which city is warmer. (3 points)

Answers: 2

You know the right answer?

TKSC Company has one employee, Reba Shas. FICA Social Security taxes are 6.2% of the first $117,000...

Questions

Physics, 18.08.2020 14:01

Computers and Technology, 18.08.2020 14:01

Computers and Technology, 18.08.2020 14:01

Mathematics, 18.08.2020 14:01

Mathematics, 18.08.2020 14:01

Mathematics, 18.08.2020 14:01

Mathematics, 18.08.2020 14:01

Mathematics, 18.08.2020 14:01

Computers and Technology, 18.08.2020 14:01