Mathematics, 07.04.2020 18:52 hey2000

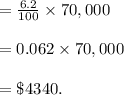

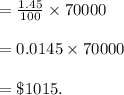

Susan, a recent college graduate, makes a base salary of $70,000 per year. Susan has federal income tax withholding of $12,000, and state tax withholding of $4,000. Employers are required to withhold a 6.2% Social Security tax and a 1.45% Medicare tax. What is Susan's take-home pay?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 13:00

Find and simplify an expression for the area of five rows of x squares with side lengths of x centimeters .

Answers: 3

Mathematics, 21.06.2019 17:00

How many credit hours will a student have to take for the two tuition costs to be equal? round the answer to the nearest tenth of an hour.

Answers: 1

Mathematics, 22.06.2019 00:00

Which of the following is the maximum value of the equation y=-x^2+2x+5 a. 5 b. 6 c. 2. d. 1

Answers: 1

You know the right answer?

Susan, a recent college graduate, makes a base salary of $70,000 per year. Susan has federal income...

Questions

Social Studies, 01.01.2020 16:31

Mathematics, 01.01.2020 16:31

History, 01.01.2020 16:31

Computers and Technology, 01.01.2020 16:31

Mathematics, 01.01.2020 16:31

Mathematics, 01.01.2020 16:31

Mathematics, 01.01.2020 16:31

Business, 01.01.2020 16:31

Mathematics, 01.01.2020 16:31

History, 01.01.2020 16:31

Social Studies, 01.01.2020 16:31

Mathematics, 01.01.2020 16:31

Mathematics, 01.01.2020 16:31