Mathematics, 14.04.2020 22:20 thawkins79

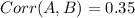

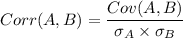

Consider two securities, A and B. Securities A and B have a correlation coefficient of 0.35. Security A has standard deviation of 12%, and security B has standard deviation of 25%. Calculate the covariance between these two securities.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 13:30

What are correct trigonometric ratios that could be used to determine the length of ln

Answers: 3

Mathematics, 21.06.2019 19:00

Atriangle has a side lengths of 18cm, 80 cm and 81cm. classify it as acute obtuse or right?

Answers: 2

Mathematics, 21.06.2019 22:00

10 points? ? +++ me asap gabriella uses the current exchange rate to write the function, h(x), where x is the number of u.s. dollars and h(x) is the number of euros, the european union currency. she checks the rate and finds that h(100) = 7.5. which statement best describes what h(100) = 75 signifies? a) gabriella averages 7.5 u.s. dollars for every 100 euros. b) gabriella averages 100 u.s. dollars for every 25 euros. c) gabriella can exchange 75 u.s. dollars for 100 euros. d) gabriella can exchange 100 u.s. dollars for 75 euros.

Answers: 2

Mathematics, 21.06.2019 22:20

An object in geometry with no width, length or height is a(n):

Answers: 1

You know the right answer?

Consider two securities, A and B. Securities A and B have a correlation coefficient of 0.35. Securit...

Questions

Physics, 03.12.2021 21:10

Social Studies, 03.12.2021 21:10

Law, 03.12.2021 21:10

Computers and Technology, 03.12.2021 21:10

Mathematics, 03.12.2021 21:10

Business, 03.12.2021 21:10

Mathematics, 03.12.2021 21:10