Garth's taxable income last year was $97,450. According to the tax table

below, how much tax d...

Mathematics, 06.05.2020 04:31 reedj7736

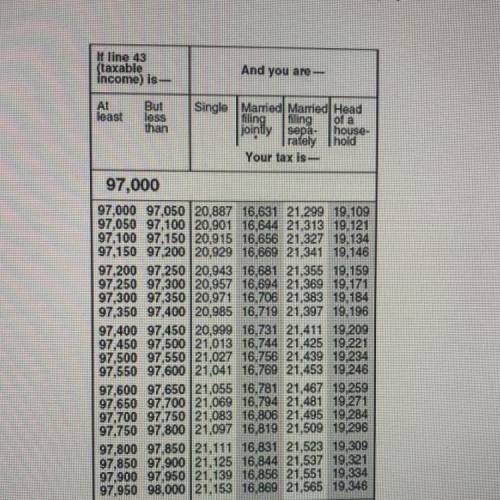

Garth's taxable income last year was $97,450. According to the tax table

below, how much tax does he have to pay if he files with the Single status?

A. $21,013

B. $16,731

C. $16,744

D. $20,999

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:00

!! 10 ! a westbound jet leaves central airport traveling 635 miles per hour. at the same time, an eastbound plane departs at 325 miles per hour. in how many hours will the planes be 1900 miles apart?

Answers: 1

Mathematics, 21.06.2019 19:00

What is the best way to answer questions with a x expression in the question. for example 3x + 10x=?

Answers: 1

Mathematics, 21.06.2019 19:00

Which graph represents the parent function of y=(x+2)(x-2)

Answers: 1

Mathematics, 21.06.2019 19:30

You deposit $5000 each year into an account earning 3% interest compounded annually. how much will you have in the account in 30 years?

Answers: 3

You know the right answer?

Questions

English, 13.11.2020 05:30

Mathematics, 13.11.2020 05:30

Biology, 13.11.2020 05:30

Mathematics, 13.11.2020 05:30

History, 13.11.2020 05:30

Mathematics, 13.11.2020 05:30

History, 13.11.2020 05:30

Mathematics, 13.11.2020 05:30

Mathematics, 13.11.2020 05:30

Mathematics, 13.11.2020 05:30

Mathematics, 13.11.2020 05:30

Physics, 13.11.2020 05:30