Mathematics, 05.05.2020 04:57 conyabrew82

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 5%, and the marketâs average return was 12%. Performance is measured using an index model regression on excess returns.

Stock A Stock B

Index model regression estimates 1% + 1.2(rM â rf) 2% + 0.8(rM â rf)

R-square 0.599 0.448

Residual standard deviation, Ï(e) 10.7% 19.5%

Standard deviation of excess returns 22% 25.7%

Calculate the alpha for each stock:

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Asap i need it now choose all the answers that apply. sex-linked disorders affect males more than females affect females more than males can be carried by females, without being expressed are always expressed in males are caused by genes carried on the x and y chromosomes

Answers: 1

Mathematics, 21.06.2019 17:30

During a bike challenge riders have to collect various colored ribbons each 1/2 mile they collect a red ribbon each eighth mile they collect a green ribbon and each quarter mile they collect a blue ribbion wich colors of ribion will be collected at the 3/4 markrer

Answers: 3

Mathematics, 21.06.2019 20:00

0if x and y vary inversely and y=6 as x=7, what is the constant of variation?

Answers: 1

Mathematics, 22.06.2019 02:00

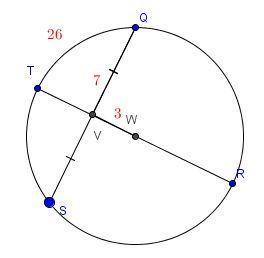

Find the distance of the blue line between the two labeled points. round to the nearest hundredth. a) 7.07 b) 7.21 c) 10 d) 5.12

Answers: 3

You know the right answer?

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free ra...

Questions

Mathematics, 21.02.2021 03:20

Mathematics, 21.02.2021 03:20

History, 21.02.2021 03:20

Biology, 21.02.2021 03:20

Mathematics, 21.02.2021 03:20

Mathematics, 21.02.2021 03:20

Mathematics, 21.02.2021 03:20

History, 21.02.2021 03:20

Mathematics, 21.02.2021 03:20