Mathematics, 09.06.2020 11:57 RandomLollipop

HELP

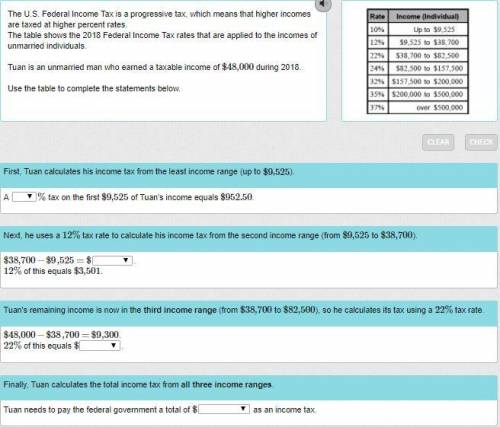

The U. S. Federal Income Tax is a progressive tax, which means that higher incomes are taxed at higher percent rates.

The table shows the 2018 Federal Income Tax rates that are applied to the incomes of unmarried individuals.

Tuan is an unmarried man who earned a taxable income of $48$48,000000 during 2018.

Use the table to complete the statements below.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:00

What value of x will make the triangles similar by the sss similarity theorem?

Answers: 3

Mathematics, 21.06.2019 19:00

What is the correlation coefficient between the variables? round to three decimal places. enter your answer in the box

Answers: 2

Mathematics, 22.06.2019 00:30

Which graph of a hyperbola represents the equation 16x^2-y^2=16

Answers: 1

You know the right answer?

HELP

The U. S. Federal Income Tax is a progressive tax, which means that higher incomes are taxed a...

Questions

Biology, 22.07.2020 01:01

Business, 22.07.2020 01:01

Mathematics, 22.07.2020 01:01