Mathematics, 17.06.2020 09:57 fordd4

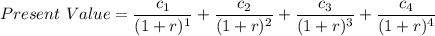

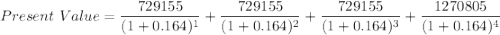

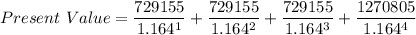

A company is planning a four-year project, with an initial cost of $1.67 million. This investment cost is amortised to zero over four years on a straight-line basis. However, the asset could be disposed of for $435,000 in four years. The project requires $198,000 in working capital initially and is fully recoverable after the project is completed. The project generates $1,850,000 in sales and $1,038,000 in costs each year. If the tax rate is 21% and the required return rate is 16.4%, what is NPV?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

How many of the 250 grandparents in the population would you expect to prefer online shopping with merchant a? merchant a: 4 merchant b: 6 merchant c: 2 merchant d: 3 other: 5 none: 5 answer choices: a.about 4 b.about 8 c.about 40 d.about 21

Answers: 1

Mathematics, 21.06.2019 21:30

Mr. vector door is buying two new cowboy hats all together the hats cost $75.12 the second heart cost twice as much as the first hat what is the price of the more expensive at round to the nearest hundredth

Answers: 1

You know the right answer?

A company is planning a four-year project, with an initial cost of $1.67 million. This investment co...

Questions

History, 26.01.2020 22:31

Mathematics, 26.01.2020 22:31

Mathematics, 26.01.2020 22:31

Mathematics, 26.01.2020 22:31

History, 26.01.2020 22:31

Mathematics, 26.01.2020 22:31

Physics, 26.01.2020 22:31

Computers and Technology, 26.01.2020 22:31

Social Studies, 26.01.2020 22:31