Mathematics, 21.06.2020 16:57 marelinatalia2000

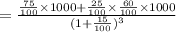

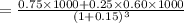

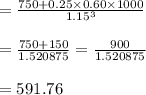

A corporate bond has a coupon rate of 5.5 percent, a $1,000 face value, and matures three years from today. The corporation is in a serious financial situation and has announced that no future annual interest payments will be paid and that the probability the entire face value will be repaid is only 75 percent. If the entire face value cannot be paid, then 60 percent of the face value will be repaid. All payments will be made three years from now. What is the current value of this bond at a discount rate of 15 percent?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:30

Suppose your school costs for this term were $4900 and financial aid covered 3/4 of that amount. how much did financial aid cover? and how much do you still have to pay?

Answers: 1

Mathematics, 22.06.2019 01:00

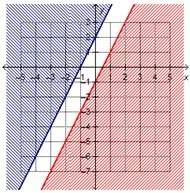

Suppose your sat score is 2040. a college with an average sat score for admintted students of which of these would most likely be your best option?

Answers: 1

Mathematics, 22.06.2019 02:00

There are a total of 75 students in the robotics club and science club. the science club has 9 more students than the robotics club. how many students are in the science club?

Answers: 1

Mathematics, 22.06.2019 03:00

Griffin ordered a pair of sneakers online. he had a $22 credit that he applied toward the purchase, and then he used a credit card to pay for the rest of the cost. if the shoes cost $58, how much did griffin charge to his credit card when he bought the sneakers?

Answers: 1

You know the right answer?

A corporate bond has a coupon rate of 5.5 percent, a $1,000 face value, and matures three years from...

Questions

Mathematics, 26.02.2021 23:30

Biology, 26.02.2021 23:30

History, 26.02.2021 23:30

Mathematics, 26.02.2021 23:30

Mathematics, 26.02.2021 23:30

Mathematics, 26.02.2021 23:30

Mathematics, 26.02.2021 23:30

English, 26.02.2021 23:30

English, 26.02.2021 23:30