Mathematics, 25.06.2020 07:01 wendelljo61

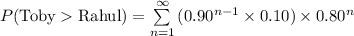

Automobile policies are separated into two groups: low-risk and high-risk. Actuary Rahul examines low-risk policies, continuing until a policy with a claim is found and then stopping. Actuary Toby follows the same procedure with high-risk policies. Each low-risk policy has a 10% probability of having a claim. Each high-risk policy has a 20% probability of having a claim. The claim statuses of policies are mutually independent. Calculate the probability that Actuary Rahul examines fewer policies than Actuary Toby.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:00

Alawn mower manufacturer incurs a total of 34,816 in overhead costs and 388 per lawn mower in production costs. how many lawn mowers were manufactured if the average cost of productions is 660

Answers: 3

Mathematics, 21.06.2019 20:00

Need ! the total ticket sales for a high school basketball game were $2,260. the ticket price for students were $2.25 less than the adult ticket price. the number of adult tickets sold was 230, and the number of student tickets sold was 180. what was the price of an adult ticket?

Answers: 1

Mathematics, 21.06.2019 20:30

Interest begins accruing the date of the transaction except for auto loans mortgages credit card cash advances credit card purchases

Answers: 1

Mathematics, 21.06.2019 22:30

Which expressions equal 9 when x=4 and y=1/3 a. x2+6y b. 2x + 3y c. y2-21x d. 5 (x/2) -3y e. 3x-9y

Answers: 2

You know the right answer?

Automobile policies are separated into two groups: low-risk and high-risk. Actuary Rahul examines lo...

Questions

Social Studies, 05.10.2019 04:30

English, 05.10.2019 04:30

Physics, 05.10.2019 04:30

Physics, 05.10.2019 04:30

Mathematics, 05.10.2019 04:30

Physics, 05.10.2019 04:30

Physics, 05.10.2019 04:30

Physics, 05.10.2019 04:30