Mathematics, 01.07.2020 16:01 isaiaspineda09pe6ljq

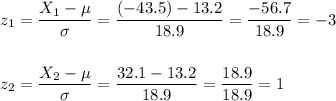

A portfolio has average return of 13.2 percent and standard deviation of returns of 18.9 percent. Assuming that the portfolioi's returns are normally distributed, what is the probability that the portfolio's return in any given year is between -43.5 percent and 32.1 percent?

A. 0.950

B. 0.835

C. 0.815

D. 0.970

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:00

At the many chips cookie company they are serious about the number of chocolate chips in their cookies they claim that each cookie hasn't c chips. if their claim is true there will be 200 chips in 10 cookies

Answers: 2

Mathematics, 21.06.2019 18:20

What is the solution set of the quadratic inequality x^2-5< or equal to 0

Answers: 1

Mathematics, 21.06.2019 19:00

What is the best way to answer questions with a x expression in the question. for example 3x + 10x=?

Answers: 1

You know the right answer?

A portfolio has average return of 13.2 percent and standard deviation of returns of 18.9 percent. As...

Questions

Mathematics, 25.10.2019 18:43

Mathematics, 25.10.2019 18:43

Mathematics, 25.10.2019 18:43

Social Studies, 25.10.2019 18:43

History, 25.10.2019 18:43

Mathematics, 25.10.2019 18:43