Mathematics, 08.07.2020 09:01 aime005

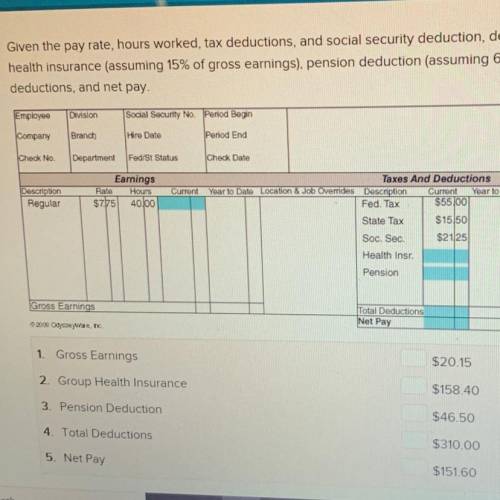

Given the pay rate, hours worked, tax deductions, and social security deduction, determine the gross earnings, group

health insurance (assuming 15% of gross earnings), pension deduction (assuming 6.5% of gross earnings), total

deductions, and net pay.

Employee

Division

Social Security No. Period Begin

Company

Branch

Hiro Date

Porod End

Check No

Department

Fed/St Status

Check Date

Description

Regular

Earnings

Rate Hours

$7.75 40,00

Taxes And Deductions

Current Year to Date Location & Job Overrides Description Current Year to Date

Fed. Tax $55,00

State Tax $1550

Soc. Sec. $2125

Health Insr.

Pension

Gross Earnings

Total Deductions

Net Pay

2000

Oreo

1 Gross Earnings

$20.15

2. Group Health Insurance

$158.40

3. Pension Deduction

$46.50

4 Total Deductions

$310.00

5. Net Pay

$151.60

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 20:30

Select all expressions that are equivalent to 2(3x + 7y). question 1 options: 6x + 14y 6x + 7y 1(6x + 14y)

Answers: 1

Mathematics, 21.06.2019 22:00

Write an inequality for this description. - one fourth of the opposite of the difference of five and a number is less than twenty.

Answers: 1

Mathematics, 21.06.2019 22:10

Which equation is y = -6x2 + 3x + 2 rewritten in vertex form?

Answers: 1

You know the right answer?

Given the pay rate, hours worked, tax deductions, and social security deduction, determine the gross...

Questions

Mathematics, 13.09.2019 00:30

English, 13.09.2019 00:30

History, 13.09.2019 00:30

Biology, 13.09.2019 00:30

History, 13.09.2019 00:30

History, 13.09.2019 00:30

English, 13.09.2019 00:30