Mathematics, 15.07.2020 21:01 Jasten

The Capital Asset Pricing Model (CAPM) is a financial model that assumes returns on a portfolio are normally distributed. Suppose a portfolio has an average annual return of 14.7% (i. e. an average gain of 14.7%) with a standard deviation of 33%. A return of 0% means the value of the portfolio doesn't change, a negative return means that the portfolio loses money, and a positive return means that the portfolio gains money. USE THE TI CALCULATOR FUNCTIONS TO COMPUTE YOUR ANSWER.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:40

Need ! discuss how to convert the standard form of the equation of a circle to the general form. 50 points

Answers: 1

Mathematics, 21.06.2019 18:00

A. 90 degrees b. 45 degrees c. 30 degrees d. 120 degrees

Answers: 2

Mathematics, 22.06.2019 01:20

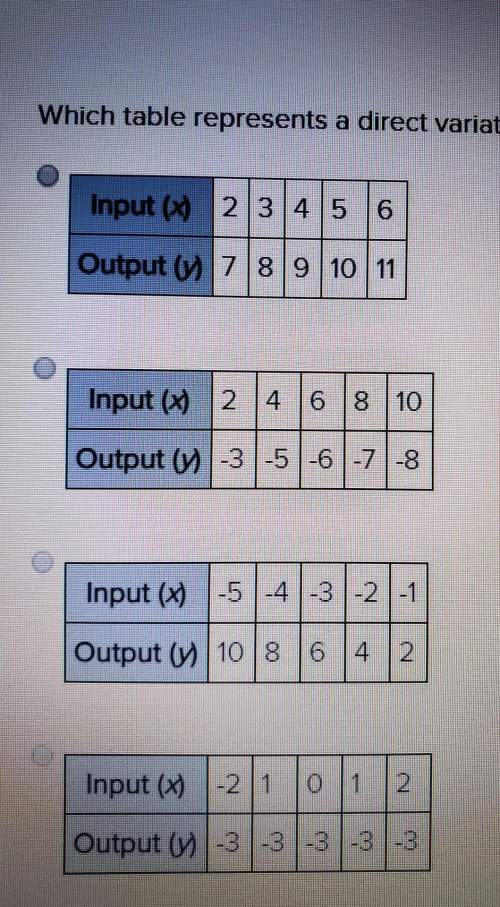

If x varies directly as y, and x = 7.5 when y = 10, find x when y = 4

Answers: 1

You know the right answer?

The Capital Asset Pricing Model (CAPM) is a financial model that assumes returns on a portfolio are...

Questions

Mathematics, 16.03.2022 15:00

Mathematics, 16.03.2022 15:00

English, 16.03.2022 15:00

Mathematics, 16.03.2022 15:00

Mathematics, 16.03.2022 15:00

English, 16.03.2022 15:00

Mathematics, 16.03.2022 15:00

Mathematics, 16.03.2022 15:00

Mathematics, 16.03.2022 15:00

Social Studies, 16.03.2022 15:00