Mathematics, 28.08.2020 03:01 RoyalGurl01

Ryan earns $18.750 per year as a teaching assistant in graduate school. He has $1,500 in personal exemptions. Use the table below to determine how much is

withheld from Ryan's monthly paycheck for state income tax,

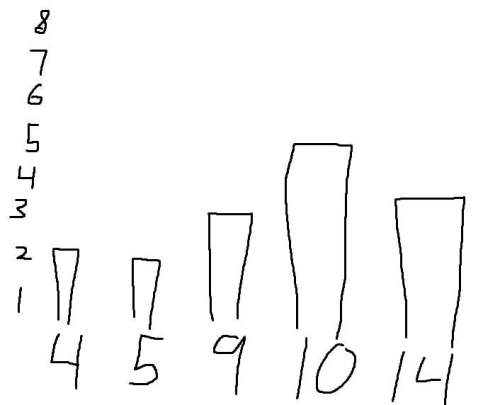

Annual Gross Pay Tax Rate

First $1,000 1.5%

Next $2,000 3%

Next $2.000 4.5%

Over $5,000

5%

$1,102.50

$777.50

$1.047.50

$852.50

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 23:30

Solve this 364x-64x=300x and 12(x2–x–1)+13(x2–x–1)=25(x2–x–1)

Answers: 1

Mathematics, 22.06.2019 04:30

Liang bought a basket of apples to make pies for her friends. the basket of apples weighed p pounds. before she had time to make the pies, she ate 3 pounds of apples. there are 17 pounds of apples left to make pies.

Answers: 2

Mathematics, 22.06.2019 05:00

In the triangle below, what is the length of the side opposite the 60° angle?

Answers: 1

Mathematics, 22.06.2019 05:30

The john deere company has found that revenue,in dollars, from sales of heavy-duty tractors is a function of the unit price p, in dollars, that it charges. if therevenue r is r(p)= -1/2p^2 +1900pa)how much revenue will the company generate if they sell 700 tractors? b) how many tractors does the company want to sell to maximize the revenue?

Answers: 1

You know the right answer?

Ryan earns $18.750 per year as a teaching assistant in graduate school. He has $1,500 in personal ex...

Questions

Mathematics, 18.12.2020 20:50

Mathematics, 18.12.2020 20:50

Spanish, 18.12.2020 20:50

Mathematics, 18.12.2020 20:50

Mathematics, 18.12.2020 20:50

History, 18.12.2020 20:50

Mathematics, 18.12.2020 20:50

Mathematics, 18.12.2020 20:50

Mathematics, 18.12.2020 20:50

History, 18.12.2020 20:50