Mathematics, 20.09.2020 14:01 cbehunter05

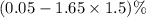

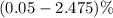

Assume that the standard deviation of daily returns for Marcus, Inc. stock in a recent period is 1.5 percent. Furthermore, a 95 percent confidence interval is desired for the maximum loss. Daily returns are normally distributed, and the expected daily return is 0.05 percent. What is the lower boundary of the maximum expected loss

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:50

Iq scores for adults age 20 to 34 years are normally distributed according to n(120, 20). in what range does the middle 68% of people in this group score on the test?

Answers: 1

Mathematics, 21.06.2019 20:00

Write each of the following numerals in base 10. for base twelve, t and e represent the face values ten and eleven, respectively. 114 base 5 89t base 12

Answers: 1

Mathematics, 21.06.2019 20:30

The areas of two similar triangles are 72dm2 and 50dm2. the sum of their perimeters is 226dm. what is the perimeter of each of these triangles?

Answers: 1

You know the right answer?

Assume that the standard deviation of daily returns for Marcus, Inc. stock in a recent period is 1.5...

Questions

Business, 16.10.2020 02:01

Mathematics, 16.10.2020 02:01

History, 16.10.2020 02:01

Spanish, 16.10.2020 02:01

Mathematics, 16.10.2020 02:01

Mathematics, 16.10.2020 02:01

English, 16.10.2020 02:01

Biology, 16.10.2020 02:01

Physics, 16.10.2020 02:01

Mathematics, 16.10.2020 02:01

English, 16.10.2020 02:01

away from the average.

away from the average.