Mathematics, 22.09.2020 16:01 lliaaaa

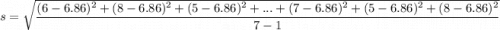

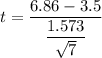

The bad debt ratio for a financial institution is defined to the dollar value of loans defaulted divided by the total dollar value of all loans made. Suppose that a random sample of 7 Ohio banks is selected and that the bad debt ratios (written as percentages) for these banks are 6%, 8%, 5%, 9%, 7%, 5% and 8%. Banking officials claim that the mean debt ratio for all Midwestern banks is 3.5 percent and the mean bad debt ratio for Ohio banks is higher. Set up the null and alternative hypotheses needed to attempt to provide evidence supporting the claim that the mean bad debt ratio for Ohio banks exceed 3.5 percent. (a) H0: μ ≤ [ Select ] % versus Ha: μ > [ Select ] %. (b) Discuss the meanings of a Type I error and a Type II error in this situation. Type I : Conclude that Ohio's mean debt ratio is [ Select ] 3.5 % when it actually is 3.5%. Type II : Conclude that Ohio's mean debt ratio is [ Select ] 3.5 % when it actually is 3.5%.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:50

Which of the following describes the graph of y--4x-36 compared to the parent square root function? stretched by a factor of 2, reflected over the x-axis, and translated 9 units right stretched by a factor of 2, reflected over the x-axis, and translated 9 units left stretched by a factor of 2, reflected over the y-axis, and translated 9 units right stretched by a factor of 2, reflected over the y-axis, and translated 9 units left save and exit next submit

Answers: 1

Mathematics, 21.06.2019 23:00

Is a square always, sometimes, or never a parallelogram

Answers: 2

Mathematics, 22.06.2019 00:00

Can someone me with this graph problem by the way i need to know the answers by today since this assignment is due ! !

Answers: 1

Mathematics, 22.06.2019 01:30

Talia grouped the terms and factored out the gcf of the groups of the polynomial 15x2 – 3x – 20x + 4. her work is shown below. (15x2 – 3x) + (–20x + 4) 3x(5x – 1) + 4(–5x + 1) talia noticed that she does not have a common factor. what should she do?

Answers: 1

You know the right answer?

The bad debt ratio for a financial institution is defined to the dollar value of loans defaulted div...

Questions

Mathematics, 27.04.2021 16:50

Mathematics, 27.04.2021 16:50

Geography, 27.04.2021 16:50

English, 27.04.2021 16:50

Mathematics, 27.04.2021 16:50

Chemistry, 27.04.2021 16:50

Mathematics, 27.04.2021 16:50

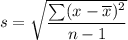

= 6.86

= 6.86

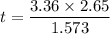

, we reject the null hypothesis and conclude that the claim that the mean bad debt ratio for Ohio banks is higher than the mean for all financial institutions is true.

, we reject the null hypothesis and conclude that the claim that the mean bad debt ratio for Ohio banks is higher than the mean for all financial institutions is true.