Mathematics, 29.09.2020 14:01 sswaqqin

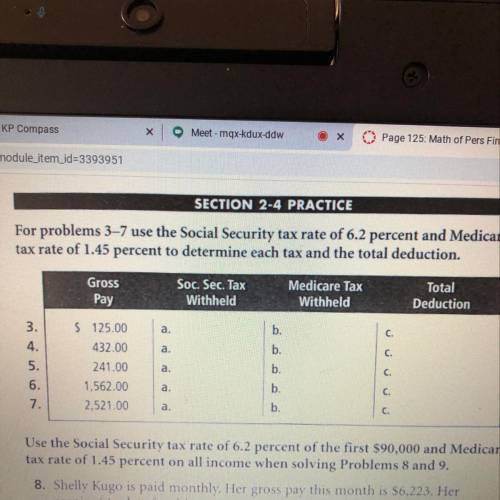

SECTION 2-4 PRACTICE

For problems 3–7 use the Social Security tax rate of 6.2 percent and Medicare

tax rate of 1.45 percent to determine each tax and the total deduction.

Gross Soc. Sec. Tax Medicare Tax

Total

Pay

Withheld

Withheld

Deduction

3.

a.

C!

b.

b.

а.

C.

4.

5.

$ 125.00

432.00

241.00

1,562.00

2,521.00

a.

b.

C.

a.

b.

c.

6.

7.

b.

C.

a.

US 4

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:30

Jackie purchased 3 bottles of water and 2 cups of coffee for a family for $7.35. brian bought 4 bottles of water and 1 cup of coffee for his family for $7.15. how much does each bottle of water cost? how much does each cup of coffee cost? i need this done

Answers: 3

Mathematics, 22.06.2019 00:10

Juanita wade's new car has an msrp of $28,902.11 including title and processing fees. the premier package which includes surround sound and dvd player costs three times the amount of the in-style package which includes leather seats and select wheels. the total cost of her new car was $34,290.08 which included the 6.5% sales tax. find the cost of the premier package to the nearest cent.

Answers: 3

Mathematics, 22.06.2019 05:30

What is the explicit formula for this sequence -7, -4, -1, 2, 5

Answers: 1

You know the right answer?

SECTION 2-4 PRACTICE

For problems 3–7 use the Social Security tax rate of 6.2 percent and Medicare<...

Questions

Mathematics, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Physics, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Social Studies, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Health, 29.09.2020 14:01

English, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01