Mathematics, 16.10.2020 19:01 ani61

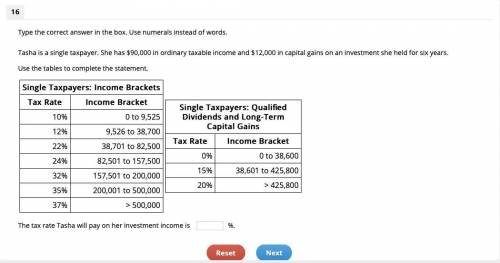

Tasha is a single taxpayer. She has $90,000 in ordinary taxable income and $12,000 in capital gains on an investment she held for six years. Use the tables to complete the statement.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:30

Lee has $1.75 in dimes and nickels. the number of nickels is 11 more than the number of dimes. how many of each coin does he have?

Answers: 1

Mathematics, 21.06.2019 21:00

The perimeter of a rectangle is 42 inches. if the width of the rectangle is 6 inches, what is the length

Answers: 2

Mathematics, 21.06.2019 22:00

In dire need~! describe how to use area models to find the quotient 2/3 divided by 1/5. check your work by also finding the quotient 2/3 divided by 1/5 using numerical operations only.

Answers: 1

Mathematics, 22.06.2019 02:00

Which is the best estimate of the product of 0.9 x 0.88? 0 0.25 0.5 1

Answers: 2

You know the right answer?

Tasha is a single taxpayer. She has $90,000 in ordinary taxable income and $12,000 in capital gains...

Questions

Physics, 19.01.2020 08:31

Mathematics, 19.01.2020 08:31

Biology, 19.01.2020 08:31

Physics, 19.01.2020 08:31

Biology, 19.01.2020 08:31

Mathematics, 19.01.2020 08:31

History, 19.01.2020 08:31

Mathematics, 19.01.2020 08:31

Mathematics, 19.01.2020 08:31

Mathematics, 19.01.2020 08:31

Social Studies, 19.01.2020 08:31

English, 19.01.2020 08:31

Mathematics, 19.01.2020 08:31